Aave For DeFi Liquidity - Issue #25

In this newsletter, we are profiling Aave. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Last week we covered the Celsius Network which is centralized finance for crypto. AAVE is decentralized finance (DeFi), and in our opinion, DeFi is the future of finance. Could AAVE be one of the best investments you make in the next year?

Profiling

First launched as ETHLend back in 2017, this decentralized financial protocol was rebranded as Aave in September of 2018. Created by serial entrepreneur Stani Kulechov, this lending and borrowing network is similar to others like Celsius, BlockFi and Nexo, except that it is fully decentralized. All funds deposited are allocated to a smart contract which is public, open-source, formally verified and audited by third parties. You can withdraw your funds at any time on demand. Seven stable coins and seventeen cryptocurrencies other than the native AAVE are supported.

Originally named ETHLend with a token called LEND, they decided to change to AAVE (which means “ghost” in Finnish), so they could offer a wider range of services. The LEND token is still used, but it is only for governance purposes now. During 2020, the 1.3 billion AAVE tokens in circulation were swapped for a newly minted AAVE cryptocurrency at a ratio of 1:100, creating a total supply of only 16 million AAVE. Transaction fees are burned.

There is another token in this ecosystem called aToken, which is given to lenders and is pegged against the value of some other token. This token is then encoded, so lenders receive interest on deposits. aTokens can be given and traded publicly as well. Borrowers can toggle between fixed and variable rates, and if AAVE is used as collateral, they get a discount on fees. Borrowers can borrow in an overcollateralized (perpetually) or undercollateralized (one-block liquidity) way.

Lenders make a profit by gaining interest when they provide funds into liquidity pools. These pools are decentralized and non-custodial. One issue, as with any system currently based on the Ethereum blockchain, is the high transaction fees for blockchain usage, which depend on the network status and transaction complexity.

Aave allows more experienced users to take advantage of flash loans. These are loans that are taken out and paid back within the same transaction, which comes in handy for purposes of arbitrage when used in a smart contract and other specific use cases. The latest iterations even allow bundled flash loans.

As with any system based solely on smart contracts, there is always the possibility of hackers finding a bug and exploiting it. There is also liquidation risk, a risk on the collateral liquidation process. Steps have been taken to minimize the risk as much as possible as the protocol code is public and open-source, and it has been audited by many knowledgeable parties. If you think you can find a bug in their code, you can participate in research and testing while possibly getting rewarded by going to https://aave.com/bug-bounty/.

The list of partnerships and integrations can be seen at https://aave.com/ecosystem.

Apart from the centralized networks we named earlier, the other main decentralized networks that compete with Aave are ones like Maker and Compound. If you wish to participate in this DeFi craze and do not trust the big centralized entities with your crypto, Aave is one of the fastest-growing alternatives to check out.

Trend Lines

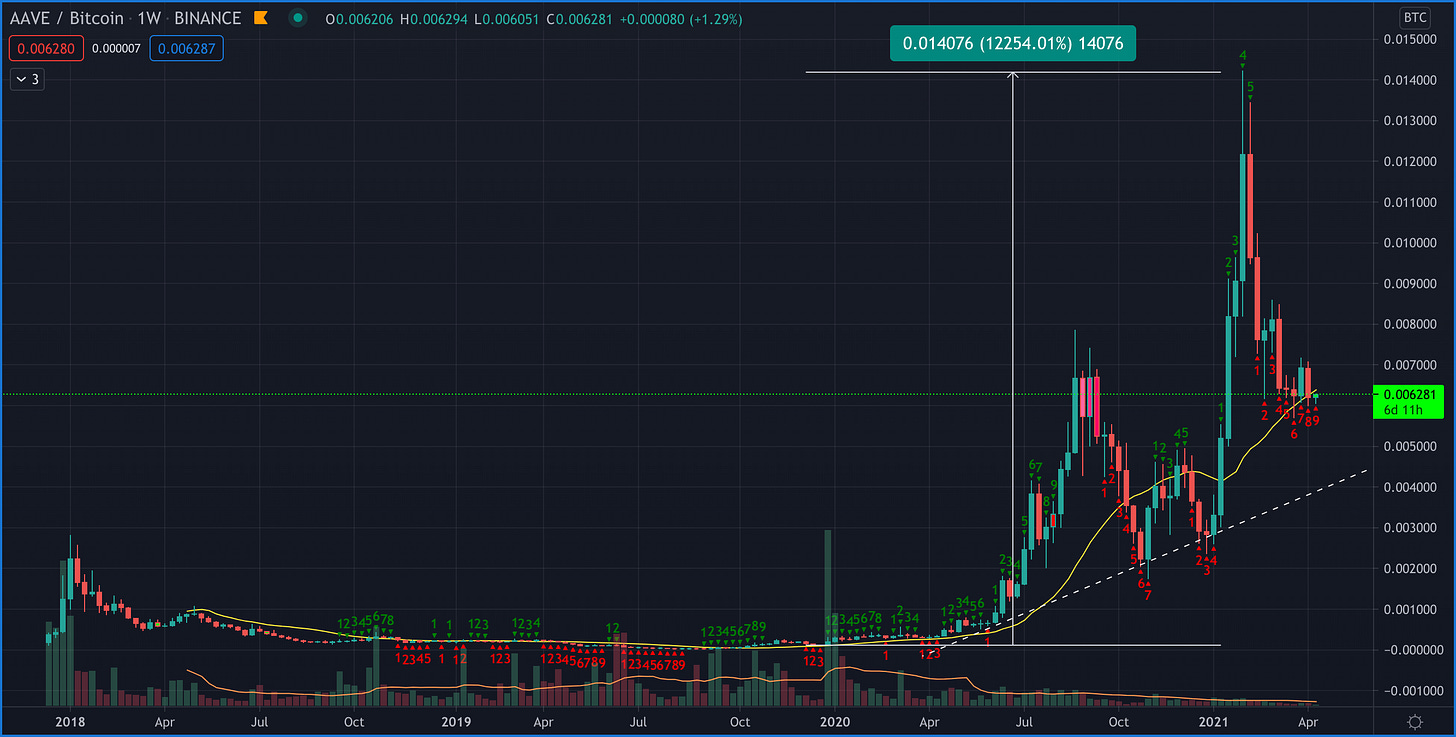

AAVE paired to BTC went up 12254% from 2020 to February 2021. From the peak, it has since pulled back 56%. We drew a support line it might come down to, which might be an additional 30-35%. It does seem that over the longer period, AAVE will have plenty more bullish momentum. In the short term, you should be careful that it does not continue down.

If you follow the TD sequential indicator, we are on a red 9 weekly candle which is the end of the countdown and could turn in the next few candles (weeks) to the upside.

On the daily chart, you can see the bearish trend we are in. When you look at the 20-day moving average (yellow line), AAVE has started going sideways. Has it found a bottom? Pay attention to the trend and see if it breaks the top of the resistance line sometime this week. That would be a good sign for more upside.

The Other Trend Lines

Since mid-March, ADA/BTC has been sticking to this pattern. It is now starting to tighten up and will need to break out before the end of the month. The support has been 2000 sats. The resistance is at about 2200.

This next chart has BNB/BTC on a weekly chart going supernova. Today it hit an all-time high against BTC and USD ($623 USD) with an increase of 918% from bottom to top. As you see, the wick has grown quite large at the top. Is BNB ready to take a breather yet? A long wick on a candlestick at the bottom or top could be a sign of a reversal about to happen or a time to go sideways as it did in March.

What is the coin forecast at the end of 2021, 2023 and as far as 2026? Check out the chart below.

ADA is one of the better investments in the next few years. Though forecasts give us some direction when investing, it can be tricky to get the predictions right. Do your own research before investing. Coin Price Forecast has more coins and traditional assets, but I chose to pick these 24 out of 37 they have listed. The top three were ADA, IOTA and LUNA. The bottom was XMR, SNX, and LTC. Of course, there will be coins that will beat out those that aren’t listed on their website, but this gives you, as a trader and an investor, some food for thought.

AAVE was the second-best in 2026 and way down in 15th place in 2021. If this forecast plays out, AAVE would be a top investment in a year. Maybe time to place a few percent of the crypto portfolio already in AAVE.

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 460% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $55,470 and $61,500 USD in value. There is a good chance we will see new all-time highs next week for Bitcoin.

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has a gain of 47% since the start. The USD fund value is up 432% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is in the minus by 3% against BTC. ETH is doing well at 29% against BTC since the start. ADA has a gain of 245% against BTC and 1139% to USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 137% against BTC since the start; LINK is down at -4%, WAVES is up 36%, XMR is up 42%. Overall, against BTC, the fund is up 47%, with WAVES and XMR gaining well.

Overall, Bitcoin should be your first choice as an investment in crypto, though many altcoins can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This weekly newsletter is a paid subscription and supports the team and the Madbyte projects. The regular cost is $5/month or $50/year. Cancel anytime.

As a paid subscriber, you can request to get access to our Madbyte Discord investor channel. In the channel, we post updates and charts related to the profiled crypto-asset. If you are already a member of our Madbyte Discord server, the investor channel is private for Madcap Tier 12 and above members and this newsletter readers. Discord invite: https://discord.gg/Pfmks83

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.