Algorand - Issue #33

In this newsletter, we are profiling Algorand [ALGO]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

This digital asset should be on your TradingView watch list and in your Exodus wallet for staking. Although, we are not sure if it is an asset for long-term holding since the large supply of coins can come to bite you in the rear. We love the tech and look forward to a lot more from Algorand.

Profiling

Algorand was created in 2017 by MIT professor Silvio Micali and had its mainnet launched in 2019. They aim to be the protocol for the next generation of financial products and to solve the blockchain trilemma by being decentralized, scalable, and secure. With a major focus on industrial use cases, they will be competing with large payment and financial networks.

ALGO is the native asset of the protocol and serves as the medium of exchange and store of value. It can currently manage up to 1000 transactions per second, with the developers working on getting that value to 10,000 over time and near-instant finality. In addition, Algorand offers highly customizable smart contracts (ASCs), Asset Tokenization (Algorand Standard Assets), and Atomic Transfers built directly in Layer-1.

There is a fixed and immutable maximum supply of ten billion ALGO, which is being distributed according to the following schedule (expected to continue until 2030):

3 billion injected into circulation in first 5 years (via public sale)

2.5 billion to early backers and relay node runners

1.75 billion to participation incentives

250 million for ecosystem supporters

2.5 billion to algorand foundation and incorporation

Block consensus is achieved via Pure Proof-of-Stake (PPoS). All users are randomly, secretly, and continuously selected to participate in the consensus protocol. The participants change every round of block selection in order to protect the network against attackers. A mechanism called the Verifiable Random Function (VRF) is used to select the participants. The VRF computation produces a pseudorandom output with cryptographic proof that anyone can use to verify the result. By sending this proof, a user can prove to anyone that they were indeed selected to participate.

Staking can be done by anyone holding at least 1 ALGO and is further staked by network validator nodes. Validator nodes are run by entities representing diverse backgrounds across many different countries. There are currently over 1000 relay and participation nodes in the network.

The Algorand core team consists of many top university brains. Silvio himself has made fundamental contributions to the theory and practice of secure two-party computation, electronic cash, cryptocurrencies, and blockchain protocols. They push hard for developer community involvement, providing the proper documentation, forums, tools and campaigns to drive adoption. Their SDK supports the programming languages of JavaScript, Python, Java, and Go. The software is completely open-source, and they accept community code contributions. Using an agile delivery process, they promise feature-rich protocol upgrades every 3 to 6 months. Visit https://community.algorand.org/ to learn more.

One of the areas of focus for Algorand is helping to create central bank digital currencies (CBDC) for governments around the world. They are currently in talks with over 15 countries, with the leading one being the Republic of the Marshall Islands. The Marshallese sovereign (SOV) could become the first state-backed digital currency to enter circulation. The stablecoin USDC uses Algorand as an official blockchain. With this focus on industrial usage and banking, Algorand’s competition could be seen as coming from cryptocurrencies like Stellar, Ripple, and Hedera.

Eventually, you will be able to trade all native assets and NFTs created on Algorand at algodex.com. They are claiming to be a no-fee decentralized exchange that will be a first of its kind.

If you like cryptocurrency ecosystems that are kept running by big brains from university settings and having serious applications in real-world monetary systems, Algorand is one to keep an eye on!

Trend Lines

On this first chart of ALGO/BTC, you can see how it came crashing down about 94% from its high in June 2019 of 34375 Satoshi. It is currently trading below 3000 Satoshi. The lowest point of ALGO against BTC was 716 sats in January 2021. Though ALGO is in a bearish trend, there can be some great shorter-term trades made. It is 37% from the resistant line, though in the middle of the trend.

When we look closer at the daily chart of ALGO/BTC, you can see the bullish channel it is in. Trading within this channel has a possibility of about 20% upside. For a swing trade, you might want to look for that dip.

Smaller volume pairings such as ALGO/BTC don’t have enough liquidity for medium to large day traders. For those who are using a few thousand USD in a trade, these are perfect for cutting your trading teeth on. The volume on ALGO/BTC on Binance today is 96 BTC / 24 hours compared to others, for example, SOL and ADA that have over 1000 BTC in volume or BTC/USDT on just Binance alone have over 2 billion USD in volume within a 24 hour period.

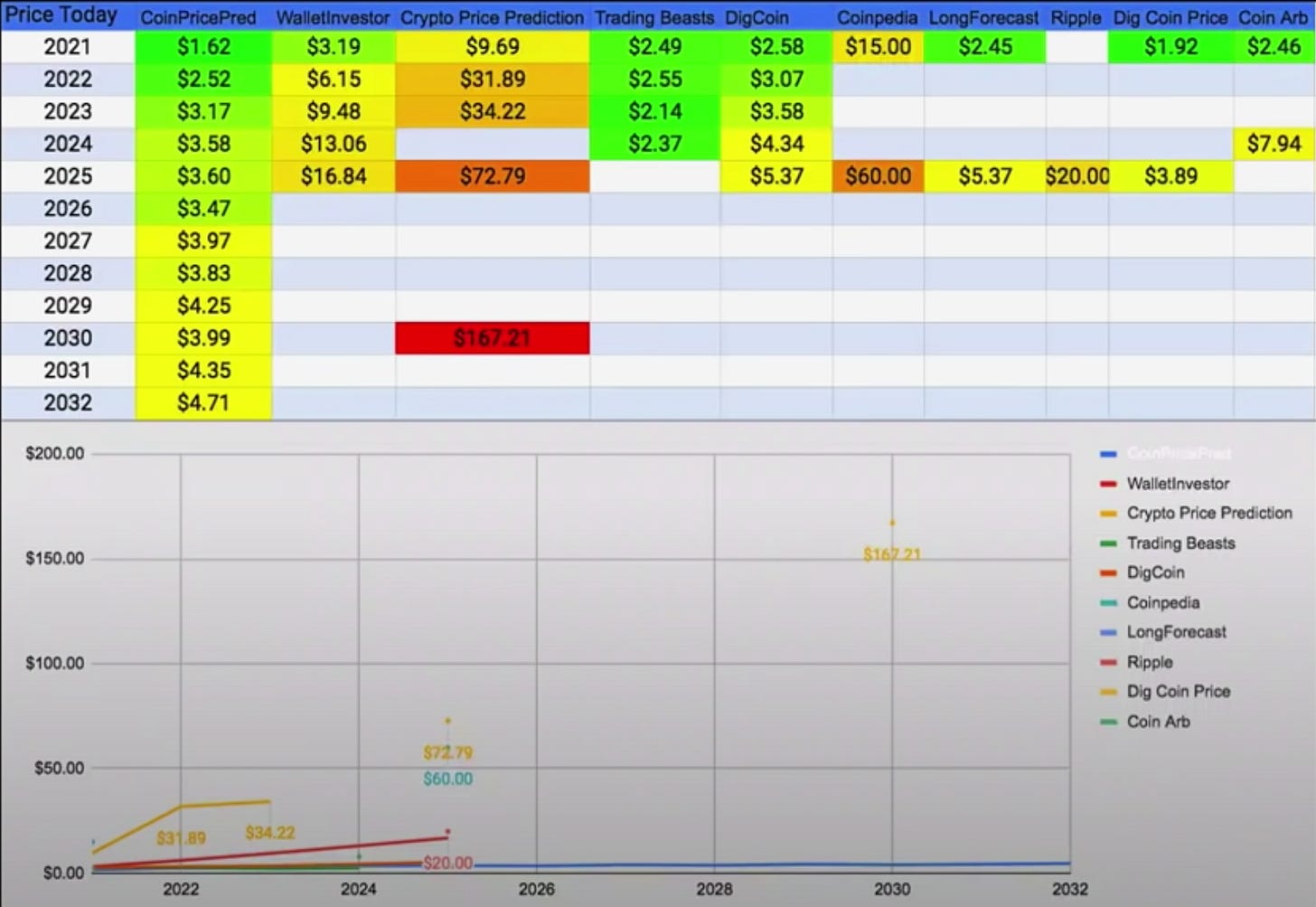

In the YouTube video below, you get price predictions for the next 10 years for ALGO and a general review.

Here’s an image from the video showing the different price predictions. In 2021 they range from $1.62 to $15.00. As you can see, some predictions are crazy high and seem unrealistic. ALGO has a vast supply of coins with more to come, which will most likely suppress the potential in the years ahead. However, there can be surprises as we have had with DOGE of late.

In this next image, we see the crazy predictions dropped. The take away though, is how the predictions consider the large number of coins yet to be put into circulation. Algorand can have huge potential as a network but maybe not so much for a long 10-year hodl. Coins with lower inflation would be better suited for long hodling.

The Other Trend Lines

What has happened since the big drop in crypto on May 19?

Bitcoin is up 21% from the lows and is going sideways.

ETH is up 39% on a bullish-looking chart.

ADA is up 52% with a great recovery but has stalled and now trading sideways with the all-time high in sight.

SOL gave us the best recovery from this group of charts at 125%.

Bitcoin is struggling against many of the top digital assets for value gain over the last few weeks, giving an opportunity for traders to make good gains in other assets such as ETH, SOL and several others.

As we profile crypto assets each week, you can get a better feel about the fundamentals of the many projects that are being worked on by some of the smartest minds in the world.

Portfolios

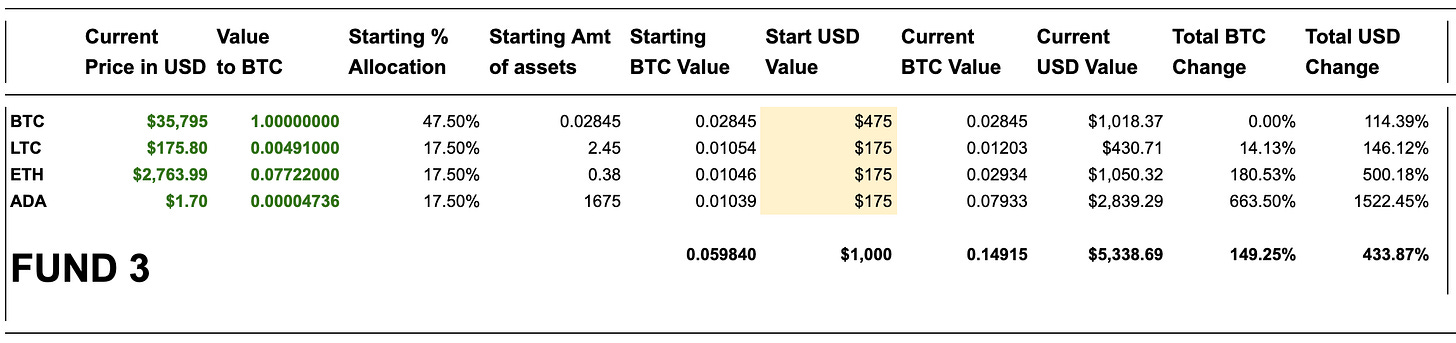

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 232% since October 1st, 2020 but down slightly from last week. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week Bitcoin has been ranging between $34,800 and $39,470 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has gained 149% since the start. The USD fund value is up 433% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is up only 14% against BTC. ETH is up 180% against BTC since the start. ADA has a gain of 663% against BTC and 1522% to USD. ADA continues to be the best investment of all the coins in this portfolio section.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has gained 109% against BTC since the start; LINK is up 35%, WAVES is up 109%, XMR is up 79%. Overall, against BTC, the fund is up 83% and 19% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This weekly newsletter is a paid subscription and supports the team and the Madbyte projects. The regular cost is $5/month or $50/year. Get it free for 90 days; cancel anytime.

As a paid subscriber, you can request to get access to our Madbyte Discord investor channel. In the channel, we post updates and charts related to the profiled crypto-asset. If you are already a member of our Madbyte Discord server, the investor channel is private for Madcap Tier 12 and above members and this newsletter readers. Discord invite: https://discord.gg/Pfmks83

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.