An Avalanche Approaches - Issue #17

In this newsletter, we are profiling Avalanche [AVAX]. In previous newsletters, we have profiled Bitcoin, Ethereum, Litecoin, Dogecoin, and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

If you haven’t seen the avalanche coming it is time to get to know something about it before it buries its competition.

Portfolio

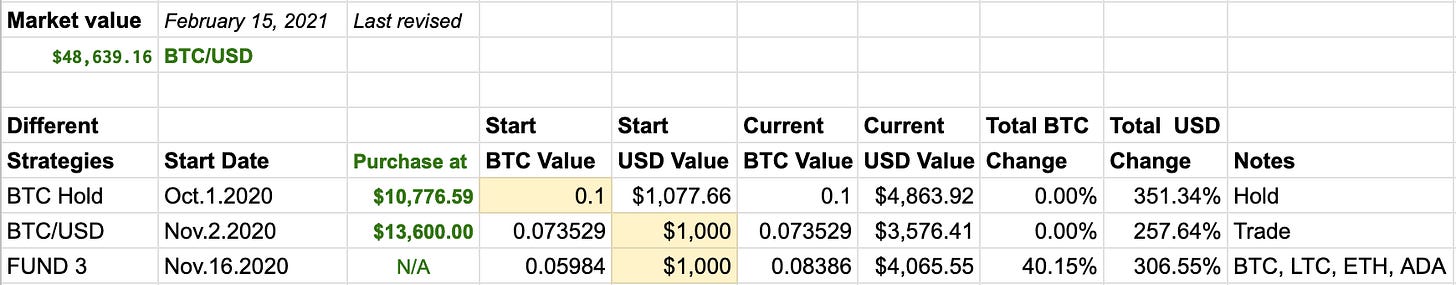

This portfolio section gives you an idea of what sort of return you can get when investing in cryptocurrencies. Over time, we will introduce other portfolios with different crypto assets.

The BTC Hold is up 351% since October 1st, 2020. Since this is a long term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long term hold position as our best stable alternative.

The BTC/USD fund is up 257% since November 2nd. This past week bitcoin has been ranging between $38,000 and $49,700 USD in value. The next to break is $50,000.

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has a gain of 40% since the start. This gain to us is an indication that alt season is happening. Against USD, it is up 306% since the start. We will hold these positions to see how well it does against our BTC-only portfolios. LTC has is up 4% against BTC. ETH is up 36% against BTC since the start. ADA is up a crazy 190% since the start against BTC.

Profiling

All the way back in 2001, Emin Sirer, a professor at Cornell University, created a cryptocurrency prototype called Karma. Not having it lead anywhere at the time, he kept teaching until 2018 when he took a leave of absence and founded a blockchain research startup called AvaLabs. They ended up launching Avalanche (AVAX), whose mainnet went live in September of 2020.

There is a maximum supply of 720 million AVAX. Avalanche really consists of 3 separate blockchains, named X, P, and C. The X chain is their main one and is used for token and collectible (NTF) transactions. It is not a standard blockchain, but rather a Directed Acyclic Graph (DAG) and can handle upward of 4500 transactions per second. Their P and C chains are more of the traditional variety. The P chain is used for platform purposes, staking, and subnets. The C chain is their EVM where smart contracts live (fully Ethereum compatible). Transfer of AVAX between the chains is very easy and can be done in-wallet.

Avalanch consensus, determined via network “gossip”, is unique in that it combines elements of both classical and Nakamoto consensus. Transaction fees are very low (currently set at a static 0.001 AVAX) and will eventually be able to be modified via governance. All fees are burned rather than going to stake holders. This makes AVAX deflationary. Avalanche nodes, run by stakers, are resource-friendly, as they don’t do anything but listen to the network unless there is work to be done. Nodes work smarter, not harder.

Staking requires a server running the Avalanchego software node and at least 2000 AVAX. People can also “delegate” to a staking node with a minimum of 25 AVAX. Staking is locked-in for the period selected (which can range from 2 weeks to 1 year). Each node requires an up-time of at least 60% to remain valid. Node operators can choose how much profit they will take from delegator rewards (ranging between 5% and 20%).

The amounts required for staking and delegating will eventually be modifiable via governance just like the fees. This functionality is expected to come in their “Apricot” upgrade later this year.

Avalanche recently released their Ethereum bridge capability, but as with any bleeding-edge technology, it wound up having a big bug that saw them shutting down their API’s for a few days and causing panic among users until a fix was implemented. Nobody lost any tokens or data, but someone did benefit from an accidental minting of 790 AVAX into their wallet. The Ethereum bridge allows the use of third-party software like Metamask and the transfer of tokens between Ethereum compatible networks. There are currently two decentralized exchanges built using Avalanche, namely Zero.Exchange and Pangolin.Exchange.

Non-fungible tokens (NFTs) can be created right within the wallet at https://wallet.avax.network. Although there is no Avalanche based marketplace for NFTs at this time, you can rest assured it’s coming. With the Ethereum bridge in place, selling at places like OpenSea can also take place.

AvaLabs has over 50 publicly visible partnerships, such as OpenFi and TrueUSD (TUSD). They recently announced Initial Litigation Offerings (ILO), where people will be able to buy into a lawsuit and get a portion of the reward if the case is settled in their favor. You can read more about the first upcoming ILO here.

The main competition to Avalanche is Ethereum 2.0, Cardano, Polkadot, and Cosmos, but with so much already in a working state and new developments coming in fast and furious, Avalanche may have a comfortable lead.

Trend Lines

AVAX has a very short history on the exchanges that we track. It was listed on September 22, 2020, on Binance. The chart below shows it increasing 1076% over 41 days.

As we zoom into the 4-hour chart we can see a trend downward and are watching to see if it will break out to test the highs or will it continue in the trend lines. The purple bar gives some support from a previous high and can be a buying opportunity. But to be on the safe side it needs to break up and out.

Altcoins have enjoyed huge runs since the beginning of the year including AVAX and some are now trying to find which ones missed the boat.

AVAX is the third most staked with over $11 billion, with Cardano leading and Polkadot next.

Bitcoin, AVAX, ADA, DOT… will they all continue after minor corrections? Is BTC going over $50,000 USD this week or today?

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This weekly newsletter is a paid subscription and supports the team and the Madbyte projects. The regular cost is $5/month or $50/year. Cancel anytime.

As a paid subscriber you can request to get access to our Madbyte Discord investor channel. Discord channel invite: https://discord.gg/Pfmks83

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.