Arweave - Issue #54

In this newsletter, we are profiling Arweave [AR]. In previous newsletters, we have profiled Bitcoin, Cardano, Axie Infinity, Solana and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Data storage has been around for a while now, but with big tech company censorship brings new opportunities for blockchain and decentralization. Will the likes of Arweave and others to follow bring with it censorless permanent content.

Profiling

Arweave is a permanent decentralized storage system that was launched in 2018. It was created by William Jones & Sam Williams, who saw a need to be able to go back in time to fetch data without the concern that it has been modified or erased. Their goal is to ensure the "collective ability to store and share information between individuals and across time to new generations."

AR is the native coin of the Arweave ecosystem and is used to pay for transaction fees, to store and retrieve data from the Blockweave, and for interacting with permaweb applications. There is a maximum supply of 66 million, with 55 million of that already minted in the genesis block. The remaining 11 million will be generated and released as mining rewards over time. 40% of the initial 55 million was sold publicly to fund the project, and the remaining had been divided up between team members and for future use.

Arwearve uses a unique type of blockchain called the Blockweave, with a Proof-of-Access (PoA) consensus mechanism. It can handle a hefty 5000 transactions per second. With PoA, miners who replicate the most data have the best chance of gaining rewards. This has the effect of assuring that electricity used while mining will decrease over time, as the amount of hashing needed decreases and reduces the cost of storing data. Data can be uploaded anonymously and shared with anybody, with demand and supply costs fairly calculated by specialized pricing functions. As for decentralization, there are currently around 500 nodes; this number will increase over time as popularity grows.

There is an official Arweave browser extension that acts as a wallet and allows you to easily archive websites to the Blockweave. Although they say you can store anything, there still exists a content moderation system. Individual nodes can reject archiving certain types of content if they so choose. Integration with Web 3.0 and IPFS ensures a smooth user experience in terms of using the network. While their smart contracts, or Permaweb apps, are currently underutilized, they will undoubtedly continue to grow as the ecosystem become more mainstream.

When looking at the price charts, you may notice that the pattern for AR closely follows Solanas SOL coin. This is because Solana decided to store all their historical blockchain data on Arweave. So, as Solana grows, they require more and more AR coins. This may be seen as a good or bad thing, as it currently makes the value of the AR coin highly dependent on how SOL is doing. If you are bullish on Solana, then you should have no worries. Other blockchains may choose to use Arweave for this purpose in the future as well, therefore alleviating the concern of being too dependent on Solana.

Competition in the crypto realm includes the likes of Filecoin, Storj, and Sia Coin, all of which could be considered temporary storage solutions as they require fees to stay accessible. Also, it costs much more to store something on Arweave as compared to centralized storage solutions like Google or Amazon. Overall, Arweave is another amazing decentralized storage solution that will certainly gain more attention as time goes on.

Trend Lines

We start with the AR/BTC chart on the daily going back to mid-May 2021 when it opened trading on Binance. Since August 2021, AR has been in a sideways pattern, with a 94% gain seen in early November. In the last ten days, it has retraced about 30%. The blue area should be good support based on previous lows and highs. Could AR breakout once it goes back to resistance next time if we see the blue acts as support once again?

On this following chart, AR is paired against USD on the daily. Once again, you see August as the start of the current trend. Here we have AR in a bullish trend with the top dotted white line as possible support. The last three peaks used it as resistance, and now it will be tested as support. The next support would be the bottom of the trendline.

The Other Trend Lines

Has ADA hit bottom on the ADA/BTC chart? It is down 50% from the previous peak. It could be a potential buy opportunity unless SOL (72.4 billion market cap) continues to devour capital away from ADA (67.5 billion market cap).

Here is a prediction from a Tradingview user showing their bullishness on ADA over the next few months.

At first ada exit from falling wedge upward, it's good signals for next grow. Current strong support level is 2.00 USD per token. Ada made pullback to resistance line of wedge which coincide with support level 2.00 USD. Now I'm expect ADA will start good upward move to previous ATH at 3.1 and higher. For higher targets we can take a level 1.618 Fibonacci is 3.85 USD per token, from current prices is around 100% net profit. Of course price can go higher, but this targets enough for me, so I expect the next pump movement. — Info and chart below from Tradingview user YMGroup

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 492% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $62,278 and $69,000 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 98% since the start. The USD fund value is up 659% since the beginning. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -4% against BTC. ETH is up 160% against BTC since the start. ADA has a gain of 411% against BTC and 1838% to USD.

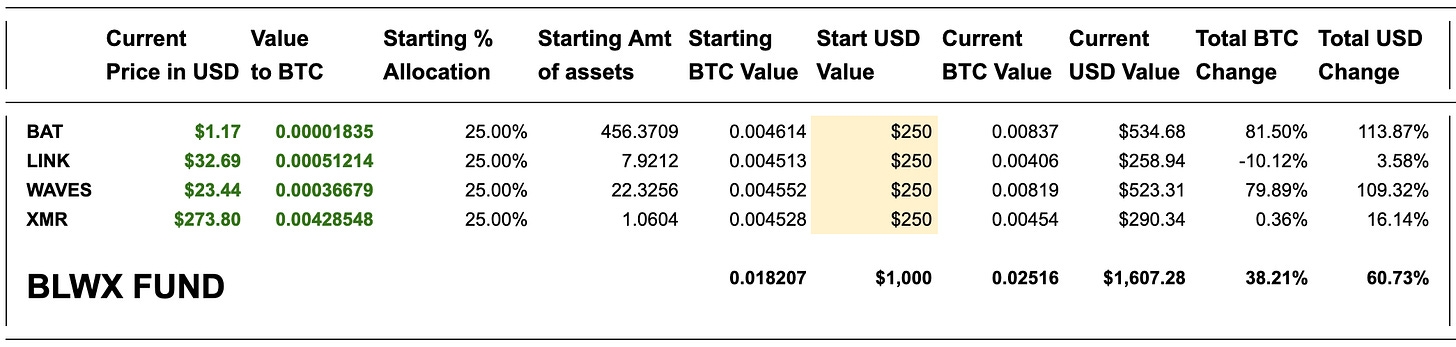

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 81% against BTC since the start; LINK is down -10%, WAVES is up 79%, XMR is up 0.3%. Overall, against BTC, the fund is up 38% and 60% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

Referral Sponsors

Join Celsius Network using the referral code 1177858d59 when signing up and earn $50 in BTC with your first transfer of $400 or more! https://celsiusnetwork.app.link/1177858d59

Use Netcoins as a Canadian to buy and sell BTC, ETH or LTC using Canadian dollars. Get a $10 bonus when you signup using this referral link.

Looking for a good crypto phone app that comes with a metal VISA card that rewards you for spending and staking? Check out the crypto.com wallet.

Bybit - Crypto derivatives and spot trading platform. Leverage trading up to 100x. Cold wallet storage. No KYC, just an email address to open an account. Zero maker fees and low taker fees. (Not available in US, China, Singapore, Cuba, Iran..) https://www.bybit.com/en-US/invite?ref=ZP2RNY

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites.

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.