Celo - Issue #60

In this newsletter, we are profiling Celo [CELO]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Celo is going after the smartphone user with an aim to make crypto use simple and easy. 84% of the world population has a smartphone, which is 6.6 billion, almost double from 6 years ago. Could Celo move from its spot at #68 into the top 20 cryptos in 2022 and drastically increase its token value?

Profiling

Celo was founded back in 2017, and its mainnet was launched in 2020. It was created by a team of developers from many top American universities, Google, Circle, Square, and VISA. Celo is an open platform that makes financial tools accessible to anyone with a mobile phone. Their main goal is to increase cryptocurrency adoption amongst smartphone users. The Celo Foundation, a non-profit organization, launched at the same time as their mainnet and is responsible for guidance and platform promotion.

The Celo ecosystem has two primary native tokens, namely CELO and CUSD. The CELO token uses Proof-of-Stake for consensus and is for paying transaction fees, staking, and participating in governance. It has a maximum supply of one billion tokens, with 60% in circulation at the mainnet launch. The remaining 40% is slated to be slowly released as rewards and via various vesting schedules. A full breakdown of the current and future distribution can be read here.

Transactions are currently configured to run at only 200 per second but theoretically can be changed to 140,000 per second. This makes Celo possibly be one of the faster smart contract blockchains. The codebase is based on a forked version of the Ethereum-go system, making it fully EVM compatible.

CUSD is their stablecoin which is pegged against the US dollar and is backed by a reserve of crypto assets. They also have another asset called Celo Gold, or CGLD, which has a fixed supply and is bought and burned or sold on a decentralized exchange to balance the peg value of CUSD. There are also already other stablecoins in the ecosystem, such as CEUR, with new ones being introduced via a governance process to ensure platform sustainability.

A user-friendly feature of Celo is the ability to use just your email and cell phone number as your public key. The Celo Wallet app interacts with the network’s smart contracts and lets you send tokens to phone contacts rather than long random character-based blockchain addresses. They also have the CeloTerminal software for desktop users. In these apps, you also have the ability to lock your Celo for up to a 5% validator staking reward. Notice that it takes three days if you wish to unstake.

A project like Luna could be considered a direct competitor. Also, fast and cheap transactions for smart contract blockchains are no longer uncommon, with projects like Solana, Fantom, and Avalanche. Can Celo’s “mobile-first” methodology cause them to become a significant player in the crypto ecosystem? Many other systems offer excellent mobile app experiences, but perhaps Celo pulls it off even better.

Trend Lines

When we pull up the CELO/BTC weekly chart, we can see how it has been bullish throughout 2021. The spread between the bottom and top support lines is 100%. If you happen to buy ideally at the low in January 2021 sell at the end of August at the peak, you would have seen a gain of 446%.

When pairing CELO/USD going back to January, there is a similar uptrend that has yet to break. The lowest was $1.58 on January 5th, and from there, it went up 359% into a peak in April before going back down to close to lows in June. The all-time high of $10.95 was on August 30th.

The current support line is at $3.60, and the top is $8.50. If the short-term trend continues to bring the price lower, there could be an excellent time to test the waters. Though trend lines are there to be broken so always be careful to manage your risk.

The market cap of CELO is $1.7 billion, and LUNA as a competitor is at $25 billion. If it was to go to that level, we could see a 15x increase over time.

Here is some extra listening from a review done in September 2021 about the potential upside of adding Defi for 6 billion smartphone users.

The Other Trend Lines

The most searched coins last week were Fantom and Celo. On August 9, 2021, we profiled Fantom (FTM) in the newsletter. At that time, it was at $0.28. Today FTM is at $2.22.

The following chart and quotes are from that newsletter back in August 2021.

We can clearly see that it is still within the downward trendlines similar to FTM/BTC charts. Look for a break above the top resistance trendline. If it breaks, then we would be looking for the $0.32 previous higher peak to be broken.

That moment in history is that tiny little arrow in the next chart. Once it broke out of that downtrend, it went up 1214%. Today it is still up 687%. Once we finish this current correction, FTM could have a good push upward again.

This next chart has BTC/USD on the weekly chart. Bitcoin over the last eight weeks has corrected 42% from the peak. We are heading into a possible turn to the upside this week. If we keep this bullish momentum we started in late 2020; this would be the bottom area. Where BTC goes, so do most other crypto assets go.

For those of you who know Arther Hayes, he had an interesting read about money printing and crypto.

Portfolios

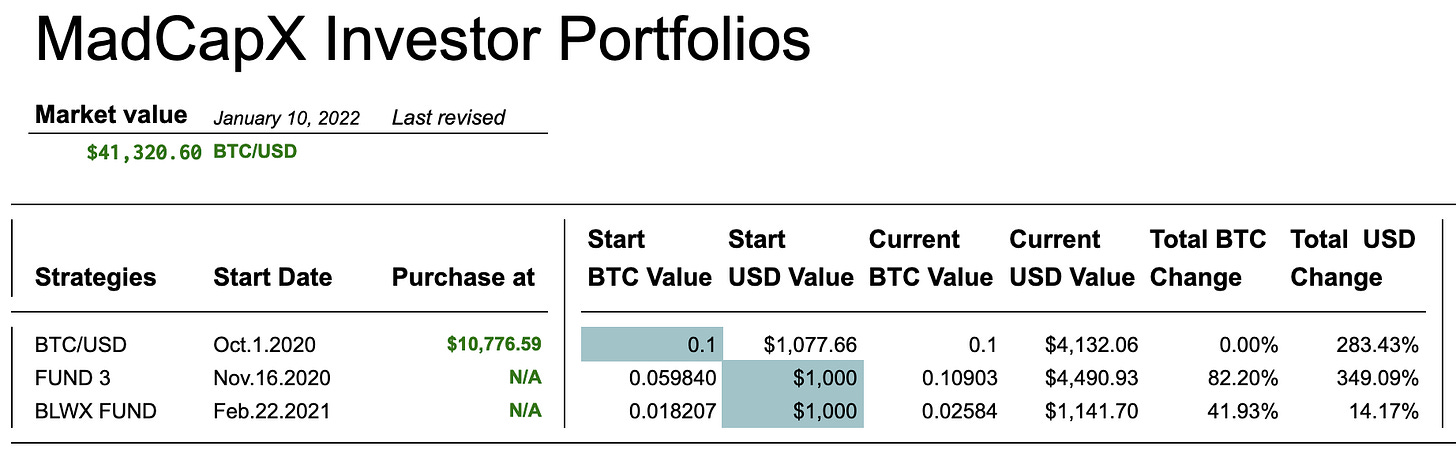

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 283% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $39,650 and $47,557 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 82% since the start. The USD fund value is up 349% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -24% against BTC. ETH is up 166% against BTC since the start. ADA has a gain of 330% against BTC and 962% to USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has gained 136% against BTC since the start; LINK is down -29%, WAVES is up 63%, XMR is down -22%. Overall, against BTC, the fund is up 41% and 14% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

Referral Sponsors

Join Celsius Network using the referral code 1177858d59 when signing up and earn $50 in BTC with your first transfer of $400 or more! https://celsiusnetwork.app.link/1177858d59

Use Netcoins as a Canadian to buy and sell BTC, ETH or LTC using Canadian dollars. Get a $10 bonus when you signup using this referral link.

Looking for a good crypto phone app that comes with a metal VISA card that rewards you for spending and staking? Check out the crypto.com wallet.

Bybit - Crypto derivatives and spot trading platform. Leverage trading up to 100x. Cold wallet storage. No KYC, just an email address to open an account. Zero maker fees and low taker fees. (Not available in US, China, Singapore, Cuba, Iran..) https://www.bybit.com/en-US/invite?ref=ZP2RNY

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites.

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.