Cosmos, the Internet of Blockchains - Issue #36

In this newsletter, we are profiling Cosmos [ATOM]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Yet another blockchain that has the features and potential going into the future that make it worth looking into. Is this a long-term investment play or best kept for a few months through the cyclical cycle?

Profiling

Cosmos had an initial coin offering in 2017 and launched in March 2019. This Proof-of-Stake system with its ecosystem of interconnected apps and services is the creation of founders Jae Kwon, Zarko Milosevic and Ethan Buchman via their Tendermint company. They claim to be building the “Internet of blockchains” or “Blockchain 3.0”. Fragmentation in the blockchain ecosystem is seen as one of the biggest issues, and Cosmos aims to remedy it.

The Cosmos hub, with its token ATOM, is just one of many hubs built using the Cosmos SDK. There is no maximum supply on ATOM, and it is considered hyperinflationary (at about 7% supply growth per year). Holders need to stake their ATOM in order to have it keep its value and to retain governance and voting rights on the Cosmos hub. Each hub is interoperable with other hubs using the inter-blockchain communication protocol (IBC).

The Proof-of-Stake consensus mechanism used for all hubs is called Tendermint (same as the development company name), which can handle transaction volume at the rate of 10,000 transactions per second. There are also a set number of 125 validator nodes on the Cosmos hub on top of the normal stakers that verify transactions. This number will go to 300 over time. Validator nodes that are found to act dishonestly are penalized and can actually lose their staked tokens.

Hundreds of projects have been built using Cosmos, with some of the bigger ones being Binance chain, Crypto.com coin, Thorchain, and KuCoin token. For a big list, check out https://cosmos.network/ecosystem/apps. The Cosmos SDK focuses on modularity which allows projects to be easily built using chunks of code that already exist. The end goal regarding development is to provide a simple structure by which to create highly complex systems.

One interesting and very recent Cosmos SDK project called Osmosis is an advanced automated market-maker protocol that allows developers to build and deploy their own customized AMMs designed for cross-chain assets.

Each hub can handle transaction fees using its own token, which might make you wonder if the ATOM token can increase in value since it’s only needed and used in the Cosmos hub. However, the Tendermint developers realized this would be an issue in the future and are currently working on extra use cases for ATOM, such as Gravity DEX and Gravity bridge.

Some other blockchain ecosystems that allow the creation of sub-blockchains and could be seen as competition are Polkadot, Algorand, Cardano, and Avalanche.

If you believe in the eventual interconnectedness of all blockchains, Cosmos may be worth your while to investigate deeper.

Trend Lines

Over the last 2 years, ATOM/BTC has been trending nicely in this range, giving us 3 peaks. The tops are separated by about 36 weeks and have increased between 200% to 300%. The overall trend is slightly leaning bearish but can also be looked at going sideways. Will the next top be mid to late January 2022 if we follow the pattern from the previous 3?

Judging by history shows ATOM could have a few more dips before finding the bottom.

The Other Trend Lines

The number one metric in crypto is how bitcoin value is doing. Is BTC heading into crypto winter, or will we see another crazy bull run that goes to 100k or even as high as 250k in 2021? So far, we are continuing in this sideways accumulation area. We tested going below $30,000, and that bounced us quickly back into the sideways trendlines.

Quote from the pomp newsletter:

By the way, yes, selling is still coming from young entities. I think this point has been made in this newsletter for well over a month now, but all indication of the age of coins being sold on-chain are still trending down. This week, long-term holders buying is now offsetting selling from short-term holders in a big way, with LTHs adding 21,136 more BTC to their holdings than STHs have reduced their holdings by.

In the last week LTHs have added 120,739 BTC while STHs have reduced their holdings by 97,333 BTC. To be noted: some of this is STH entities aging into the LTH cohort that bought Bitcoin around late January (155 day cutoff). This divergence between the two in the chart below can be interpreted differently depending on your view of market structure based on other things; it resembles what occurs both at the tail end of a bull market, but also what occurred in the middle of both previous bull markets. What you see is this large divergence between the 2013 “double pumps”, as well as a more moderate, but still noticeable divergence in late 2016. This essentially means that experienced were setting the floor for bull run continuation. I highly suspect this is what is going on now, when combined with other broader metrics that are not signaling Bitcoin being in a bear market.

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

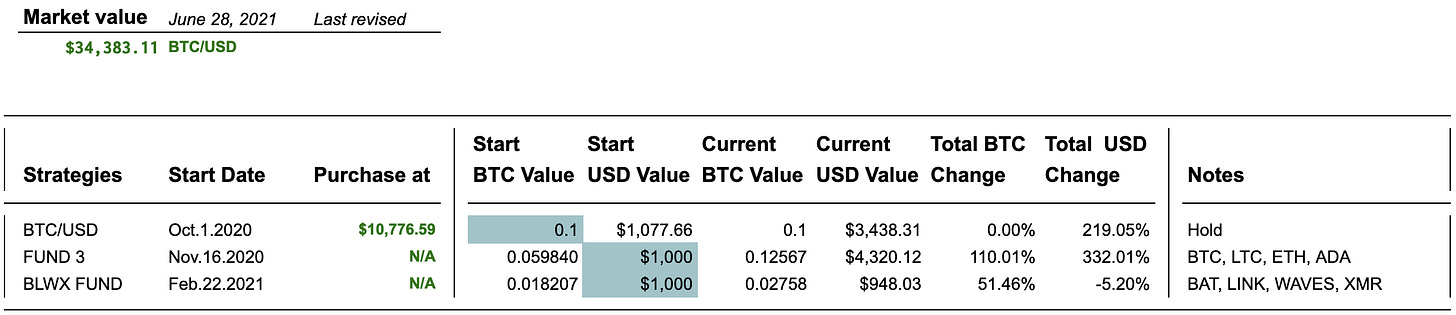

BTC/USD FUND is up 219% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $28,805 and $35,500 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has a gain of 110% since the start. The USD fund value is up 332% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -8% against BTC. ETH is up 121% against BTC since the start. ADA has a gain of 519% against BTC and 1164% against USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the newsletter, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 62% against BTC since the start; LINK is down -3%, WAVES is up 100%, XMR is up 45%. Overall, against BTC, the fund is up 51% and down -5% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This weekly newsletter is a paid subscription and supports the team and the Madbyte projects. The regular cost is $5/month or $50/year. Cancel anytime.

As a paid subscriber, you can request to get access to our Madbyte Discord investor channel. In the channel, we post updates and charts related to the profiled crypto-asset. If you are already a member of our Madbyte Discord server, the investor channel is private for Madcap Tier 12 and above members and this newsletter readers. Discord invite: https://discord.gg/Pfmks83

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.