Crypto.com - Issue #37

In this newsletter, we are profiling Crypto.com [CRO]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

The Crypto.com exchange is #10 on CoinGecko and #22 on CoinMarketCap, but the exchange is only a portion of their business. It seems that they are aiming to become the top regulated cryptocurrency platform over the next few years. Will CRO follow in BNB’s footsteps in regard to value?

Profiling

Crypto.com began in 2016, with their ERC20 token, CRO, introduced in 2018. Earlier this year, their mainnet went live, and CRO now lives on its own blockchain (see crypto.org) that was developed using the Cosmos SDK. Read our previous newsletter to see the technical specifications of Cosmos hub chains. The founders are Kris Marszalek, Rafael Melo, Gary Or and Bobby Bao. The main focus of the crypto.com network is to provide utility via making crypto usage (payments, trading, and other financial services) simple via their VISA debit card offerings.

CRO has a maximum supply of 30 billion, with over 25 billion already distributed. The final 5 billion is set to be distributed via staking over the next 10 years or so. They provide 2 smartphone apps. The first is the main crypto.com wallet which allows you to hold CRO and apply for their VISA card. The cards come in 5 tiers, and all are feeless but require differing amounts of CRO to be held in order to obtain more perks.

Midnight Blue (plastic) - requires no CRO held; offers 1% back (paid in CRO) on all purchases.

Ruby Steel (metal) - requires $400 USD worth of CRO held; offers 2% back and free Spotify service.

Jade Green (metal) - requires $4,000 USD worth of CRO held; offers 3% back and free Spotify and Netflix service.

Icy White (metal) - requires $40,000 USD worth of CRO held; offers 5% back and free Spotify, Netflix, and Amazon Prime.

Obsidian Black (metal) - requires $400,000 USD worth of CRO held; offers 8% back and free Spotify, Netflix, Amazon Prime, and other extras (hotel, Airbnb, and airport lounge discounts)

Visit https://crypto.com/cards for more details on the cards they offer. The second wallet they have is the DeFi app. This one lets users stake their tokens to help secure the network and gain higher rewards.

An NFT marketplace has recently been launched, which is already seeing considerable usage, including deals with AFA Football Technology Institute, UFC, and F1. The capability for native smart contracts is still being worked on, but their EVM Chain is launching on July 14th.

Crypto.com spends quite a bit on advertising, and their symbol/logo is starting to become recognized by even those outside the crypto ecosystem. Crypto.com is competing with other large crypto financial service entities like Binance and Coinbase with their respective cards. They are also competing with BlockFi, Nexo, and Celsius by providing high percentage rewards via staking.

If you believe that the initial way that cryptocurrency will become widely adopted is by using intermediate methods like debit cards, definitely check out the generous offerings from crypto.com.

Trend Lines

The CRO token on this weekly scale CRO/BTC chart going back to late 2018 has had a couple of swings up and a couple down. The last bullish run-up in 2020 saw CRO go up 376% over a 38 week period before crashing back down to new all-time lows in February 2021 of 149 Satoshi. Currently, at 372 Satoshi, it would be considered to be close to its lows. With the millions that Crypto.com is spending on advertising, there is a good chance many newbies researching crypto will enter through their app. If you signup through a referral link, you get about $25 in CRO. To unlock your signup bonus, you need to buy $500 worth of CRO and then stake it. Even though there are billions of CRO in circulation, which is a negative, there is a good chance those marketing dollars will push it back to the top of the weekly resistance line. If so, that would be a 3x gain in value.

On the daily CRO/BTC chart, CRO has been within this trend for the last 140 days, and yesterday it seemed it was ready to test a breakout but was rejected. Keep an eye on if a breakout happens over the next few days for a possible entry point. Or will it start another bearish move into support in the high 200’s?

On the CRO/USD weekly chart, we see an Ascending Broadening Wedge pattern that has no previous price trend to show where this pattern will move. This sort of pattern suggests increasing price volatility and increasing volume that can offer some good trading opportunities.

Ascending Broadening Wedges tend to breakout in the direction of the previous price trend and so act as continuations of this move.

There are a few ways to trade these patterns.

Once we have established the two trendlines with the three price touches on either side we can trade within the patterns themselves, taking swing trades from top to bottom and bottom to top.

For example, price makes the third valley and touches the provisional trendline (made by the first two valleys), confirming the pattern. We can then trade price up to the upper trendline. Place a tight stop below the lower trend line.

When price reaches the upper trendline again this completes the swing trade.

We can also trade upward breakouts. Following the swing up from the lower to the upper trendline should price close above the third touch to the upper trendline then this provides a confirmation entry point.

The target is the full height of the pattern, from the lowest low to the highest high forming the trendlines. Watch out for price reversing at the upper trendline on the fourth touch.

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 207% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $32,077 and $35,119 USD in value.

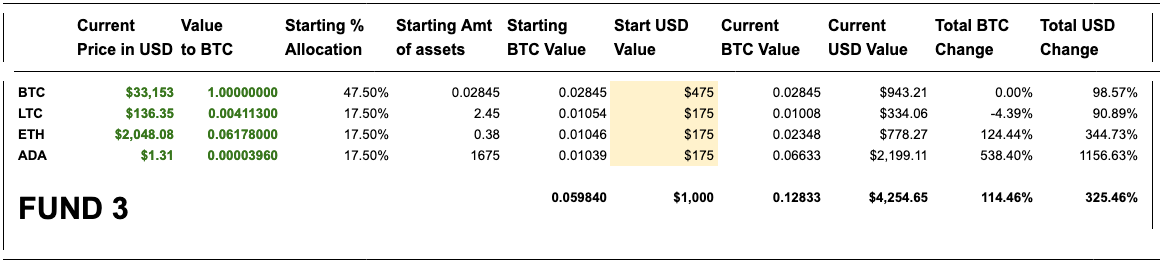

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has a gain of 114% since the start. The USD fund value is up 325% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -4% against BTC. ETH is up 124% against BTC since the start. ADA has a gain of 538% against BTC and 1156% against USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 63% against BTC since the start; LINK is down -7%, WAVES is up 105%, XMR is up 46%. Overall, against BTC, the fund is up 52% and down -8% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This weekly newsletter is a paid subscription and supports the team and the Madbyte projects. The regular cost is $5/month or $50/year. Cancel anytime.

As a paid subscriber, you can request to get access to our Madbyte Discord investor channel. In the channel, we post updates and charts related to the profiled crypto-asset. If you are already a member of our Madbyte Discord server, the investor channel is private for Madcap Tier 12 and above members and this newsletter readers. Discord invite: https://discord.gg/Pfmks83

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.