Decred, a Superior Store of Value? - Issue #29

In this newsletter, we are profiling Decred [DCR]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

We have covered several blockchains that have been totted as Ethereum challengers; Decred with its superior governance model was developed as the better Bitcoin. There are several similarities to Bitcoin, but the changes to mining, halvings, algorithm, developer fund and governance would make it the better blockchain for the long haul. But I guess the question stands do we need Decred anymore than we need 20 Ethereum killers? Does that even matter for a trader who is looking for potential profit? Maybe not.

Profiling

Decred (DCR) was launched back in 2016 with the aim of being a community-directed store of value. It was developed by Jake Yocom-Piatt, the founder and CEO of Company 0. Jake has written code that has been used in several Bitcoin-related projects as well as the Lightning Network daemon software. According to him, Decred was created to facilitate open governance, community interaction, and sustainable funding policies.

Decred was heavily influenced by Bitcoin and has the same 21 million maximum supply. Block rewards decrease by 1% every 21 days. Consensus is achieved via both Proof-of-Work (PoW) and Proof-of-Stake (PoS) mechanisms. The first 8% of DCR supply was pre-mined, with half going to an air-drop and the other half to Company 0 to help with development costs. 60% of block rewards go to PoW Miners, 30% go to PoS holders, and 10% go to fund the team treasury.

As the core coin can only handle about 3.2 transactions per second, it is dependent on its implementation of the Lightning Network to ensure speed and stability under heavy load. Their smart contracts also reside on the Lightning Network. One of the main goals of the Decred protocol is to ensure that all DCR holders have the same amount of decision-making power and that large institutions cannot control the voting. Holders can bundle their DCR into staked “tickets.” These tickets allow users to participate in validating blocks and earning the portion of staking rewards, in addition to participating in governance. Decred features “Politeia,” a dedicated voting platform by which ticket holders participate in governing the treasury of the project. They implemented this community voting in part to ensure that contentious forks do not happen (as has happened with Bitcoin).

There are many competitors in the “store of value” and “governance-focused” fields of cryptocurrency. Although Decred was one of the first to focus on these values specifically, it has not gained the traction and usage needed to keep it ahead of the pack. Still, it has a solid community and should constitute a very stable coin, worthy of being looked at by long-term investors.

Trend Lines

On this daily DCR/BTC chart, you can see that it is trending upward nicely within the support and resistance lines. Though in the last 3 weeks, it has been trending downward within the dotted lines. It needs to break up soon to continue the bullish momentum, and there is a possibility it won’t and needs to correct.

Zooming way out to a monthly DCR/BTC chart, we can see how it started into a bullish cycle like many other altcoins heading into alt-season. After two and half years of bearish sell-off, DCR is up 346%. It still has plenty to reach the alt-time high against BTC.

On the monthly pairing of DCR/USD, we can see how it is up a whopping 2166%. On this chart, it easily passed the all-time high.

In this video from a couple of weeks back, DCR had already moved up over $200 USD. There are several good charts and great analyses related to the price. One key takeaway that is mentioned is that the risk of a correction is too high in relation to the potential reward. After a drop back down to $110-130 USD, DCR could be a good buy opportunity, but at these prices, it just has gone past the point where one wants to go in.

The Other Trend Lines

Bitcoin on the 1-week chart could be drawn as an ascending triangle with the possibility of BTC staying inside for several more weeks. An ascending triangle in an uptrend tends to be bullish in nature. The breakout measurement is taken from the height of the beginning of the triangle. The further into the triangle we go, the more violent the breakout can become. For example, if we stay within this till the end of July, we are liable to break even higher than the prediction below. The chance of breaking down is approximately 35%. A breakout can happen at any time.

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 432% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $52,900 and $59,500 USD in value.

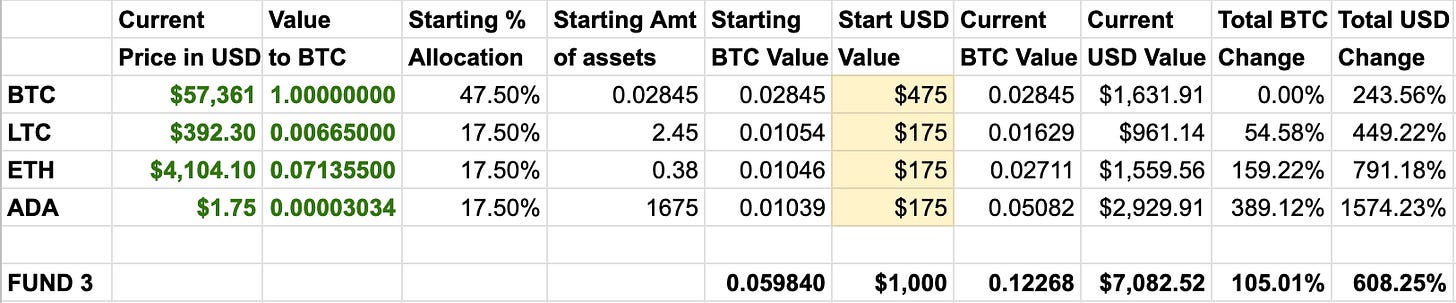

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has a gain of 105% since the start. The USD fund value is up 608% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is up 54% against BTC. ETH is up 159% against BTC since the start. ADA has a gain of 389% against BTC and 1574% to USD. Though ETH has had a fantastic move, ADA continues to be the better investment since we started comparing them. LTC also had a good move upwards as it seems to follow ETH.

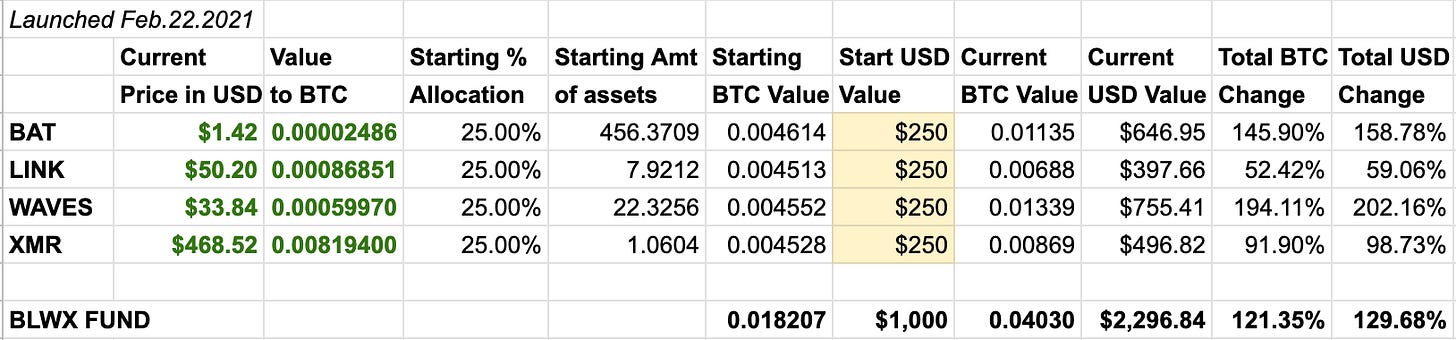

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 145% against BTC since the start; LINK is up 52%, WAVES is up 194%, XMR is up 91%. Overall, against BTC, the fund is up 121% and 129% against USD. WAVES has done super well over the last 3 weeks.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This weekly newsletter is a paid subscription and supports the team and the Madbyte projects. The regular cost is $5/month or $50/year. Cancel anytime.

As a paid subscriber, you can request to get access to our Madbyte Discord investor channel. In the channel, we post updates and charts related to the profiled crypto-asset. If you are already a member of our Madbyte Discord server, the investor channel is private for Madcap Tier 12 and above members and this newsletter readers. Discord invite: https://discord.gg/Pfmks83

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.