Elrond - Issue #57

In this newsletter, we are profiling Elrond [EGLD]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Elrond is #31 on CoinMarketCap with a $5.5 billion market cap. This past week it is down 31%, which is more than any other asset above it. Has EGLD seen its gold dull, or is it time to speculate on buying some for your portfolio?

Profiling

Elrond is a highly scalable smart contract blockchain launched in 2019, with its mainnet going live in 2020. Their first token was ERD (an ERC20) which was swapped to their current native token, EGLD (or eGold). The founders are visionary entrepreneurs, namely brothers Beniamin and Lucian Mincu, along with Lucian Todea.

Seeing the issues with scaling on the Ethereum blockchain, Elrond was developed with easy scalability in mind via sharding. It focuses on providing security, efficiency, scalability, and interoperability. To be able to fulfill these goals, a consensus mechanism called Secure Proof of Stake (SPoS) is employed. The network can currently handle about 10,000 transactions per second but can quickly scale by enabling more of their adaptive state shards. It has been tested in a public setting to be able to maintain 263,000 TPS, with extra shards activated as needed. Their sharding architecture is built in such a way that it protects against malicious attacks. They claim to be the first smart contract blockchain that shards all the elements of their state, network and transactions. The current primary shards in the ecosystem are the coordinator shard and three execution shards. Validator nodes, of which there are currently over two thousand, are shuffled between the shards and ensure secure transactions between them.

There is a maximum supply of a little over 31 million EGLD. The token is used to pay for transaction fees, deploying decentralized applications, staking, governance, and other rewards for contributions to the network. Elrond does hope to also firmly establish EGLD as a store-of-value asset. The transaction fees are minimal, and cross-shard transaction finality is only a matter of seconds. The Maiar wallet application is made to be easy to use and requires only your phone number without the need for usernames, passwords, or recovery phrases.

Whenever smart contracts are run on the blockchain, fees are taken, of which a 30% royalty goes to the contract author. This is to encourage developers to create decentralized applications on the platform. The Elrond virtual machine (EVM) allows developers to write their smart contracts in Rust, C/C++, C#, or Typescript and compile them using WebAssembly (WASM). Elrond allows the creation of advanced tokens (Elrond Standard Digital Tokens) and NFTs.

Again, another worthy competitor in the world of smart contract ecosystems, made to compete with the likes of Ethereum and Algorand. In terms of sharding technology and implementation, Elrond is currently the clear leader. The only issue being that other platforms have massive marketing drives, sponsorships, and partnerships happening. Will Elrond eventually compete in that regard?

Trend Lines

The EGLD paired against BTC shows it being in a bullish trend since June 2020. In August 2021, it created the bottom of the current trendline and has not gone back to test it. From that point, we draw another trend that gives us another bottom in mid-October. That bottom gave another more bullish trendline that we can see has been hit several times, including on the last day. As you can see from this chart, how bullish 2021 is in general, but over the last couple of months, the crypto market may have gone up to fast and is in need of this correction. From the peak, we are down 47%, and if we break, we could see EGLD test the next trendline or even head back down to the longer trendline support.

In the following chart, EGLD against USD shows us the all-time low of $6.00 and high of $544, which is an 8300% gain. Since we started the last bull cycle in July 2021, EGLD has had a gain of 723% at its peak. Twice we have gone above the current trendline shown below, with the latest bursting through it. In return, when it came back down, the support was lost. EGLD dropped down to $226 and could be a good bottom as it acted as resistance in April 2021 and acted as support throughout October 2021.

The Other Trend Lines

Over the last few days, Bitcoin and the crypto market, in general, are in a correction, with BTC going as low as $42,000 USD on Binance. That is a similar area where it topped out in January 2021. That $41-42k area has played pretty good support and resistance, with it being resistance about three times and support now twice. The whole of crypto does use Bitcoin as the value gauge, and so we see it react to its movements. There have been many crypto enthusiasts that have been in the space for a few years that have added to their portfolios. As some would say, buy the dip. (not financial advice)

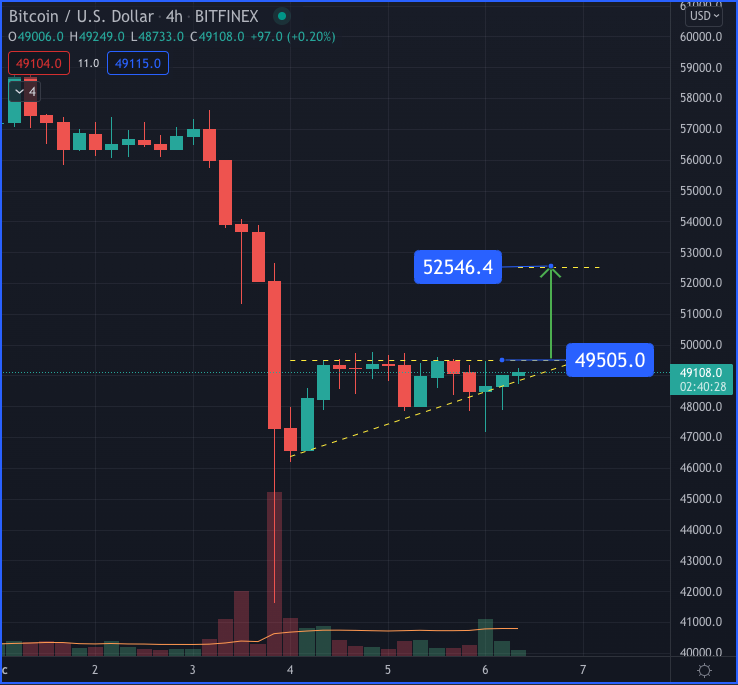

As we zoom into BTC/USD pairing, we can see the pattern that is happening. If we see a candle close above $49,500, we might be in for a push up to about $52,500 before a retest.

The next bit is posted from another newsletter worth following from Coin Bureau:

Given the massive fall that we saw on Friday / Saturday, I could not help but to buy the dip. There are many reasons as to why I think this is just a temporary shakeout (see below).

I bought some more ETH, BTC & MATIC with fiat. The first two are obvious given my view on the long term potential of Ethereum & Bitcoin. They still are and will remain staples of my portfolio. When it comes to MATIC, the sheer development taking place on Polygon makes it hard not to be bullish and I will be doing an updated video on the project in due course.

I used my UST in order to pick up some more FTM & ATOM. When it comes to the former, I explained the potential I see in the project in my video on Fantom a few weeks ago. In terms of the latter, Cosmos’ SDK is the backbone of many crypto projects and as an interoperability play, it cannot be ignored.

I have also recently had an allocation of XDEFI released to me as I partook in a private sale a few months ago. For full transparency, I will update my portfolio as tokens like this are unlocked and vested.

Updated portfolio:

ETH 32.10% | BTC 22.23% | SOL 13.55% | DOT 9.56% | ATOM 4.40% | FTM 2.82% | HNT 2.75% | PAXG 2.74% | RUNE 2.40% | ADA 1.99% | INJ 1.70% | MATIC 1.66% | AR 1.05% | LINK 0.78% | XDEFI 0.25%

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 355% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $42,000 and $59,176 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 90% since the start. The USD fund value is up 458% since the beginning. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -28% against BTC. ETH is up 207% against BTC since the start. ADA has a gain of 337% against BTC and 1174% against USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 150% against BTC since the start; LINK is down -33%, WAVES is up 90%, XMR is down -5%. Overall, against BTC, the fund is up 51% and 35% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

Referral Sponsors

Join Celsius Network using the referral code 1177858d59 when signing up and earn $50 in BTC with your first transfer of $400 or more! https://celsiusnetwork.app.link/1177858d59

Use Netcoins as a Canadian to buy and sell BTC, ETH or LTC using Canadian dollars. Get a $10 bonus when you signup using this referral link.

Looking for a good crypto phone app that comes with a metal VISA card that rewards you for spending and staking? Check out the crypto.com wallet.

Bybit - Crypto derivatives and spot trading platform. Leverage trading up to 100x. Cold wallet storage. No KYC, just an email address to open an account. Zero maker fees and low taker fees. (Not available in US, China, Singapore, Cuba, Iran..) https://www.bybit.com/en-US/invite?ref=ZP2RNY

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites.

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.