Enjin for Gaming - Issue #15

In this newsletter, we are profiling Enjin [ENJ]. In previous newsletters, we have profiled Bitcoin, Ethereum, Litecoin, Dogecoin, and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Gaming is a 2.5 billion person marketplace with Enjin doing a good job of integrating crypto and gaming. Are they doing enough to be the major player within crypto to capture the gamer? Is ENJ getting ready to bounce for its largest gains?

Portfolio

This portfolio section gives you an idea of what sort of return you can get when investing in cryptocurrencies. Over time, we will introduce other portfolios with different crypto assets.

The BTC Hold is up 202% since October 1st, 2020. Since this is a long term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long term hold position as our best stable alternative.

The BTC/USD fund is up 139% since November 2nd. This past week bitcoin has been ranging between $29,240 and $38,530 USD in value. Since the high of almost $42,000 USD on January 8th, we have been trending lower. The lows of $28,850 was a 31% correction from the highs which is in line with the expected amount before we continue moving upwards.

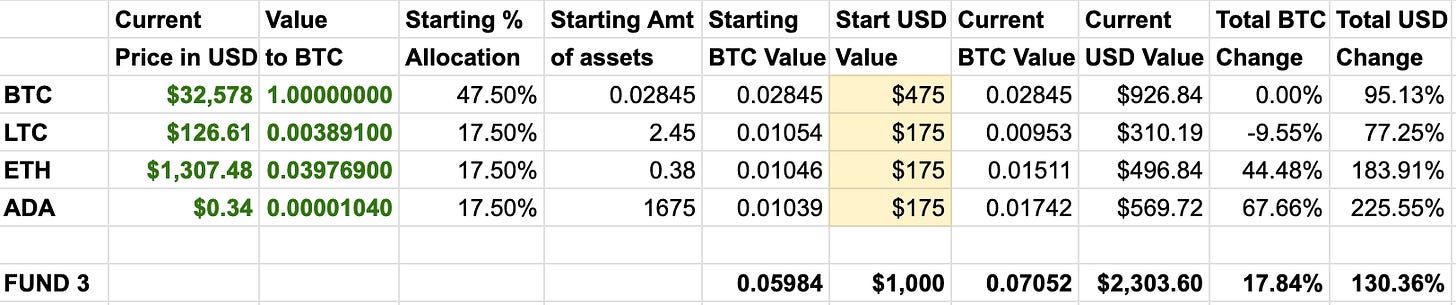

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has a gain of 17% since the start. Against USD, it is up 130% since the start. We will hold these positions to see how well it does against our BTC-only portfolios. LTC is at a loss of -9.5% against BTC. ETH is up 44% against BTC since the start. ADA is up 67% since the start against BTC.

Profiling

Founded as a community gaming company in Singapore in 2009 by Maxim Blagov and Witek Radomski, Enjin saw the launch of its ERC-20 token, ENJ, in June of 2018. Continuing on the social gaming theme, their flagship product is the Enjin Network which allows players to host sites, clans, chats, and virtual item stores. They are the first gaming token that was approved for use in Japan. ENJ has a maximum supply of one billion tokens which were distributed as follows: 40% presale, 40% ICO, 10% freebies to server hosts, 10% team/advisors.

There have been many attempts to push game developers to tokenize in-game items on the Ethereum blockchain and Enjin has been quite successful at it. You can browse their large digital marketplace at https://enjinx.io/eth/marketplace. If you are interested in seeing games, services, and websites that have already integrated ENJ in some form, check out https://enjinx.io/eth/projects. A great incentive for gamers to be involved with Enjin-backed games is that items can be bought, sold, and traded with real-world value. Enjin has partnerships with companies such as Atari, eBallR Games, Imperial News Network, and several Minecraft related services.

In essence, the Enjin ecosystem is a set of contracts to create and manage NFTs (Non-Fungible Tokens) living on the Ethereum network with a slew of services and offerings controlled by the Enjin team. They created the new ERC-1155 protocol which allows for a number of both fungible (where tokens are all the same) and non-fungible (all tokens are unique or in sets of uniqueness) items to be deployed through a single contract. Enjin has no plans to create its own mainnet coin and will continue to live on the Ethereum blockchain. While the main focus continues to be gaming, the team has mentioned that is by no means limited to that. It will be interesting to see what directions they explore as they move forward.

Trend Lines

In this first chart, we are looking at Enjin Coin on the 1-week candle chart. Meaning each bar line you are looking at represents a week in time. When we look for trading patterns in a chart it is more difficult when working with only a few years. But here is our best effort to see if some sort of pattern is visible. The three peaks are separated by about 60+ weeks. The third one is smaller but from the lows to the peak is still 400% increase. Could the dip we had a few weeks ago below 400 sats been the bottom for this next cycle. Is that red resistance line pushing it back down for one more low before heading for the next high or even a new all-time-high?

This second chart is from alanmasters. We can see that there is a breakout on the last green candle from the downward momentum we have been having since May 2020. The RSI looks like it will crossover and is turning. The MACD is also looking bullish.

The third chart is from NaS_Almutairi. This chart is from December 17, 2020. You can see in the shaded area is his future prediction for ENJ paired against BTC. The prediction was to bottom at the start of January and then rise and dip once again for a correction before continuing upward. So far the chart is nailing it. Now to see if we will break upwards this week and rise above the previous peak in late May 2020 and then have another correction. This chart takes a bold all-time-high prediction of 0.00012 which is double the previous all-time-high before crashing back down to earth. Here are the user’s comments from the chart below:

— Dec. 17, 2020

Comment: All my reasons are in the chart of why going to 0.00012. The best buying time of alts is going to be this mid-end of December, I said this since the start of this year. Buy at whatever is the price from 20th of December 2020. Sell minimum 10x of any coin. (this fit all alt coins, but some hit higher than 10x, some 20x...etc). Thank me later, those questioning this. Just watch.

— Jan 19

Comment: 120% up since buying price call

Comment: 200%+

— Jan 20

Comment: 300%+

— Jan 25

Comment: Following the pattern 100%

Last week we wrote about DOGE coin and posted this chart from a Tradingview user. The top was at 217 sats and we said we can’t see it going there since we don’t think the community was there to push it that high. But DOGE was tweeted by a user with over 400,000 users and is a member of the Reddit wallstreetbets subgroup with over 7.4 million users. So yes when an alt gains a massive community it can move quickly.

As you see that last green candle on DOGE on Poloniex exchange broke the top green line but did not stay up there very long. On Kraken, it went as high as 313 sats. That is a massive wick above the solid part of the candle. Is this the start of seeing other alts seeing massive candles and wicks soon?

Be careful when this sort of hype happens. DOGE pumpers have been targeting $1 in the past and it is fallen way short of that goal. In most cases, once you start chasing an alt like DOGE going up like this, you are most likely already late to the show. DOGE is fun to trade and buy when it is in the lows of 20 sats or so and wait for that pop. If DOGE was worth $1 per coin it would be more than double the market cap of bitcoin. So totally unrealistic for a $1 DOGE in the foreseeable future. The pump we had last week for DOGE was within the normal cyclical pattern it has had for many years. DOGE could range for a few weeks above the yellow line but if looking at history it can now start its casual move back down.

Grayscale, the largest crypto asset manager, has incorporated six more trusts this week, Polkadot (DOT), Aave (AAVE), Monero (XMR), Cardano (ADA), Cosmos (ATOM), and EOS.IO (EOS). The CEO has said that it does not mean they would launch these products. In previous weeks they have also incorporated trusts for Chainlink (LINK), Tezos (XTZ), Basic Attention Token (BAT), Decentraland (MANA), Livepeer (LPT), and Filecoin (FIL).

Ray Dalio is the founder of the world’s largest hedge fund and has been traditional anti-Bitcoin but has changed his tune as of late saying “Bitcoin won’t escape our scrutiny” and calling Bitcoin “one hell of an invention”. The Bridgewater investing legend is warming up to the largest cryptocurrency saying it could fill the growing need as an alternative to gold.

MicroStrategy CEO Michael Saylor continues to be bullish on buying more bitcoin. “Going forward, we continue to plan to hold our bitcoin and invest additional excess cash flows in bitcoin. Additionally, we will explore various approaches to acquire additional bitcoin as part of our overall corporate strategy,” Saylor said in the company’s quarterly filing.

And then we have Elon Musk of Tesla who is currently the richest person in the world. He changed his profile on Twitter this past week to say only #bitcoin. No Tesla, SpaceX, Boring Company, Starlink, or any other project he is evolved in, just bitcoin. Of course, this caused a spike. The Elon tweeter effect.

Willy Woo put out a tweet “While we are in the first great consolidation of the 2021 bull market, here's a bunch of charts to get the feel of where we are in this bull cycle.” Here is one of them:

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This weekly newsletter is a paid subscription and supports the team and the Madbyte projects. Subscribe for free and get a limited-time complimentary paid subscription and access to all our archives. The regular cost is $5/month or $50/year. Cancel anytime.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.