Getting Smart With Cardano - Issue #4

Cardano is the invention of Charles Hoskinson, a mathematician and co-founder of Ethereum.

The Short of It

We will be reviewing another great blockchain that has the potential to give Ethereum a run for its money over the next few years. Cardano was launched in September 2017, and the creators consider it as a third-generation cryptocurrency. It is being built from previous experience with crypto. Taking the more scientific route rather than the marketed or get-rich-quick tokens we see show up regularly.

Portfolio

This portfolio section gives you an idea of what sort of return you can have when investing in cryptocurrencies. Over time, we will introduce other portfolios with different crypto assets.

The BTC Hold is up 55% since October 1st. This will be a long hold, and it is best kept in cold wallet storage or a safe custody solution.

The BTC/USD fund is up 23% since November 2nd. This will stay on an exchange. We will be keeping a close watch on the weekly charts to see trend changes for that perfect trade out of BTC to USD. BTC has broken above $16800 USD, 17.5% away from all-time-highs. There is plenty of new money coming into Bitcoin. We are not seeing any reason to sell our BTC position.

FUND 3 started today, November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH and ADA. We will hold these positions to see how well it does against our BTC-only portfolios. LTC is trading at yearly lows, ETH is about 2% away from a bottom support, ADA is at a support line and if it breaks below it could fall another 17% or more.

Profiling

Cardano is the invention of Charles Hoskinson, a mathematician and co-founder of Ethereum. Three partner organizations make up the current team: Cardano Foundation, IOHK, and Emurgo. Many would consider it Ethereum done right, built on extensive research and peer-reviewed progression. Cardano has a total maximum supply of 45 billion coins (ticker ADA) with a currently available supply of a little over 31 billion. The ticker, ADA, is actually named after Ada Lovelace, a 19th-century mathematician recognized as the first computer programmer and daughter of the poet Lord Byron. Fourteen billion ADA is held in a treasury for payouts of staking rewards. It is not yet fully concluded how the treasury is to be replenished, but there have been suggestions that it may eventually come from transaction fees. Cardano's future will be delegated by community consensus rather than the organizations that are currently dictating the rules. This is a deliberate part of their roadmap and will be implemented in the last phase.

Development is proceeding in 5 main phases, named Byron (1, foundation), Shelley (2, decentralization), Goguen (3, smart contracts), Basho (4, scaling) and finally, Voltaire (5, governance). Phases 1 and 2 have been completed, and work is currently underway to officially release phase 3 by 2021. Phase 3 will see the implementation of smart contracts and is sure to whip up a flurry of new excitement in the community and trading speculators. Phase 4 will ensure that the system will scale with increased usage demand using technologies such as side-chains and sharding, while phase 5 will transition control of the network's future to the community.

Cardano utilizes a proof-of-stake algorithm called Ouroboros, which claims to have overcome security concerns that other PoS implementations may have. Ouroboros is said to be “provably secure,” making it firmly as reliable as proof-of-work. It has a targetted block creation time of 20 seconds, but unlike others, it is controlled via a variable parameter that can be changed. Cardona is being developed by engineers using the functional programming language called Haskell. The smart contract system, which is currently in development, will have programmers using a language called Plutus, which is based on Haskell. Haskell is commonly used in the banking and defence sectors.

Anybody can operate a staking pool with a server that stays online 24/7 and has a relatively speedy and reliable Internet connection. As a pool grows, at some point when it gains too many staking participants, the reward actually starts getting smaller. This behaviour is built into the system to dissuade any singular pool from growing too large. If you decide to stake your coins in someone’s pool, know that it does not mean you need to send them your coins. Instead, you delegate it to the pool from the settings within your Daedalus wallet. While your ADA is delegated to a pool, it cannot be moved or spent. It is also effortless to unstake your coins if desired, and it does not require a waiting period like other staking systems.

Cardano is a wise investment if you believe in a competitor to Ethereum that has done their due diligence and has a solid plan as they advance.

Trends

On the weekly ADA/BTC chart, we can clearly see that there could be a bounce off resistance at about 621 area indicated with a red line, or else we visit all the way back down into the 500 range where the bottom white line is.

When we zoom in closer and view this ADA/BTC chart on the one hour candle, you will see that it has already tested the resistance line twice and bounced up over 17% before starting to come back down over the last 10 days or so. On the previous occasion, when testing that support line, the buys came in quickly.

When trading altcoins as a day or swing trader, one should always be watching Bitcoin movement and the rest of the top altcoins to understand if they are moving somewhat together.

The graph below is an example from a bullish prediction from Nov.10 from Marketminds. The support level is placed at 701 using a daily chart where we used a weekly chart and placed support lower at 621. The upper target is showing 966, and we would place our target at about 938 if we can get a rebound off support.

And another chart from user ft-73 from TradingView and their comment and links:

ADA failed to signal a Long back in October. There's a new opportunity now, one month later. We have a falling wedge , bullish divergences and a bottoming CMF . Technically it's still early to call it a Long, you may want to wait for a wedge breakout. Personally, given current levels i think it's good enough already for accumulation.

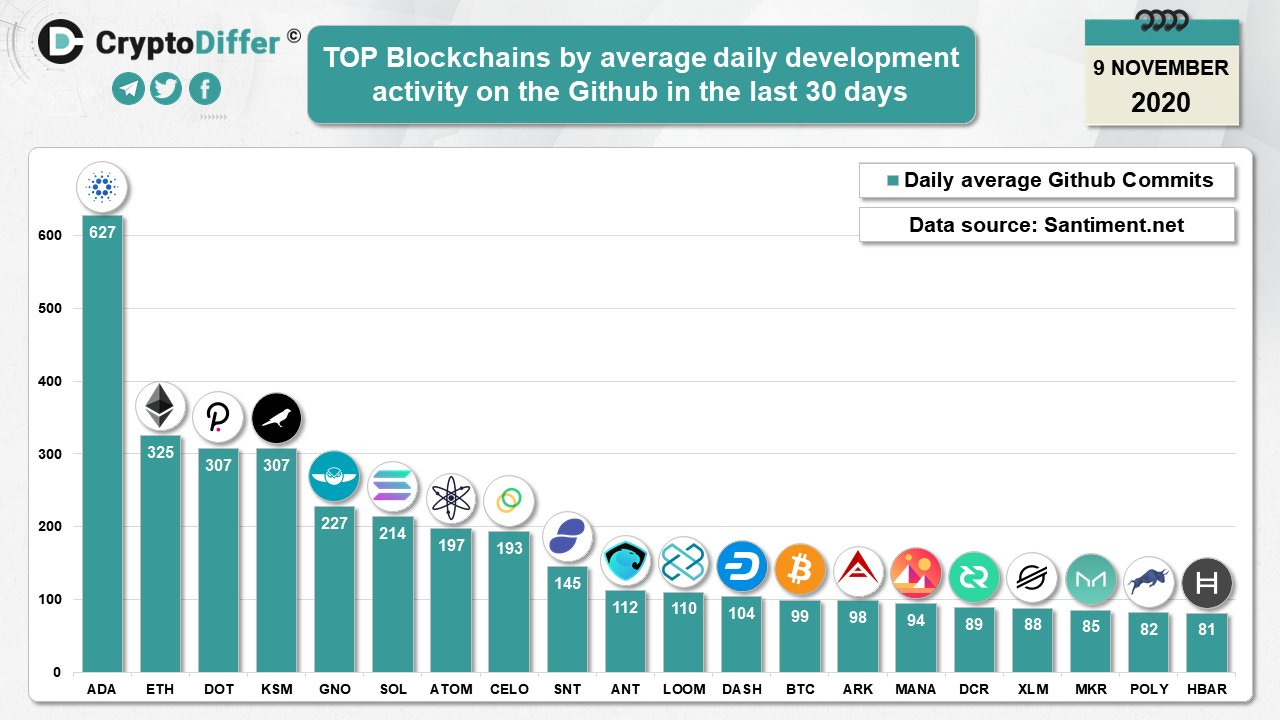

Cardano’s Github commits are almost double that of second-place Ethereum and over 6 times that of Bitcoin that appears in the 13th spot. In third is Polkadot and then followed by Kusama.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.