Holochain - Issue #35

In this newsletter, we are profiling Holochain [HOT]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Many crypto projects are vying for the top spot in the distributed application arena. We will be looking at an interesting one this week whose claim to fame is not actually being a blockchain but something with a different approach.

Profiling

Holochain is not your typical crypto project but rather a framework for building distributed peer-to-peer applications. Seasoned developers Arthur Brock and Eric Harris-Braun started work on the project in late 2016. They created an ERC20 token, HOT, which was launched in 2018 and is intended as an IOU for Holofuel (HOLO) once it is ready for use. It will be tradable at a 1:1 ratio. The Holochain ecosystem and holofuel are still in a state of development.

Holochain is to be considered a “post-blockchain” technology. It does not use blockchains or directed acyclic graphs (DAG). Instead of everyone storing the same data across the entire network, each project built using Holochain technology has its own set of rules for what/how data can be added to their specific system. These rules are shared in decentralized distributed hash tables (which you can think of as a database to store key/value pairs). There is no native consensus mechanism as each project is only required to specify data rules. Each project running on Holochain can theoretically integrate its own consensus mechanism if needed. The system is considered “agent-centric” rather than “data-centric” as blockchain systems are.

So, with this understanding, it should be noted that asking questions like what is the consensus mechanism or how many transactions per second can it handle is not applicable. No mining or staking is involved. Each individual node running a distributed application will determine its own consensus and transactions per second capabilities. As the individual nodes determine transaction validity, they are then broadcast to the rest of the network for transparency. Neighbouring nodes double-check the verifications using the distributed rules they have for that particular node.

There is a max supply of 177.6 billion HOT tokens, which you will be able to trade for Holofuel tokens once they are ready. 133.2 billion HOT (75%) was allocated for public sale, and 44.4 billion HOT (25%) was reserved for the team and company. The Holofuel token, HOLO, is what will be used to pay for running decentralized applications on Holoports, which are dedicated mini-computers that users can run to participate in the network and gain Holofuel as a reward. Holoports are not absolutely required to participate in hosting but are recommended to keep things simple for the user. It is possible to use your own hardware and set up the hosting software yourself. The Holo network can be seen as similar to Amazon Web Services (providing application hosting). While there has been alpha/beta testing going on with Holoports and Holofuel for quite some time, the system is expected to enter the next stage sometime this year, with hopefully a full public launch soon after.

There has been a flurry of development recently, which has been causing some excitement. Earlier this year, the team launched their first fully working P2P application on the network, called “Elemental Chat.” One of the main features of the Holo ecosystem is to act as a bridge from the crypto sphere onto the Internet, with the ability to host P2P dapps on the Internet for mainstream users.

As it stands, Holochain is currently a unique crypto project, with only a few others that could be considered competition (but not in the direct sense). Golum, Dfinity and ICP are blockchain-based projects which also provide a decentralized and distributed network computer on which to run your applications. If you are interested in a crypto project coming from an unconventional direction and wanting to disrupt the world of decentralized applications, look no further than Holochain.

Trend Lines

As we chart HOT/USDT on the daily, we see that from February to early During April, there was a gain of 4700%. Since the highs, it lost 85% recovered some but not enough to put it into a bull trend. There might be a chance we test those lows from May. If we go back to the January 1 price of 0.000651, then it is a loss of another 90% from today’s price. Not saying HOT will go that low, but it is good to know that it is possible since there are so many tokens in circulation.

The Other Trend Lines

Bitcoin has been in this sideways trend for 33 days; if it falls below the $30,000 price point, many expect it to test the low $20,000s. If we start trending upwards and over $42,000, that is a positive.

This next chart shows Bitcoin, and the cycle tops going back to 2011. The comment and chart are from user TradingShot.

This is BTC on the 1W time-frame in order to get all of its historic price action on one chart as I'll be looking at each Cycle on a Fib approach.

As you see each time Bitcoin made a Bull Cycle Top (red arrow) the subsequent Bear Cycle that followed never reached as low as the Previous Cycle Top ( ATH ) or even the 0.618 Fibonacci retracement (blue line) from the time the rise (on the previous Bull Cycle) turned parabolic. As parabolic I define the time it started rising aggressively following the last major pull-bac below the (at the time) ATH .

I see a growing sentiment in the crypto community that calls for a low at 20k or below. Even though that would represent an excellent long-tern buy opportunity as it would put BTCUSD again inside the long-term logarithmic Growth Curve (the dashed lines zone consisting of the lows and highs during Bear Cycles), it would mark the first time that Bitcoin will make a Bear Cycle Bottom by hitting the 0.618 Fib and the Previous ATH .

What do you think? Are we ahead of a historic first for Bitcoin or $65000 wasn't this Bull Cycle's Top?

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

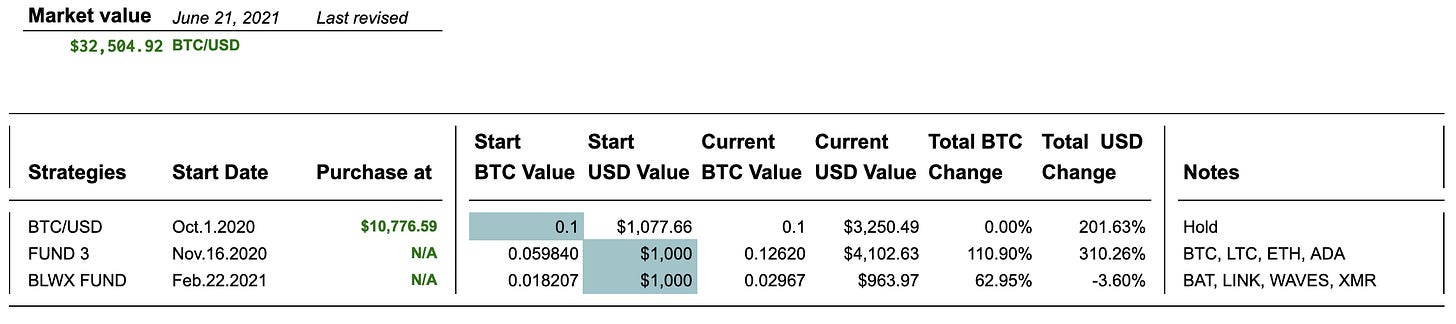

BTC/USD FUND is up 201% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $31,710 and $41,340 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has a gain of 110% since the start. The USD fund value is up 310% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -4% against BTC. ETH is up 115% against BTC since the start. ADA has a gain of 526% against BTC and 1110% to USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 57% against BTC since the start; LINK is down -0.49%, WAVES is up 134%, XMR is up 59%. Overall, against BTC, the fund is up 62% and down -3% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This weekly newsletter is a paid subscription and supports the team and the Madbyte projects. The regular cost is $5/month or $50/year. Cancel anytime.

As a paid subscriber, you can request to get access to our Madbyte Discord investor channel. In the channel, we post updates and charts related to the profiled crypto-asset. If you are already a member of our Madbyte Discord server, the investor channel is private for Madcap Tier 12 and above members and this newsletter readers. Discord invite: https://discord.gg/Pfmks83

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.