Injective Protocol - Issue #43

In this newsletter, we are profiling Injective Protocol [INJ]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

The traditional financial markets and brokers should be worried about their future as blockchain projects such as Injective Protocol target to decentralize everything financial. With Injective comes unlimited markets, borderless and no gas fees.

Profiling

Injective Protocol is a layer-2 decentralized derivatives exchange protocol that launched on the Binance Launchpad in 2020. It was founded in 2018 by Eric Chen and Albert Chon, with headquarters in New York. The goal of the project is to improve the poor liquidity, latency and lack of compelling product offerings that characterized most other decentralized exchanges. The main token is INJ, which is currently an ERC20, slated to fully migrate to their Injective mainnet during the course of this year.

The network consensus is built on Tendermint-based Proof-of-Stake (from Cosmos-SDK). Injective integrates a verifiable delay function (VDF) to prevent trade manipulation and front-running. Order books on the Injective DEX are decentralized. It also features a bi-directional token bridge, again using Cosmos technology for pegging against ETH. The whole thing runs on the Ethereum Virtual Machine (EVM) on top of the Cosmos SDK, which provides excellent scalability and interoperability. There are multiple smart contracts involved; handling trade executions, the token bridge, staking, futures, and finally, for the INJ token itself.

The INJ token is currently used for governance, fees, collateral, exchange participation incentives (for providing liquidity), and staking for security. The initial supply was set to 100 million, with a variable inflation rate of 7% to start, decreasing to 2% over time. Some INJ is burned by the protocol from trading fees. This, along with staking and collateral, will ensure that the ecosystem will actually experience deflation in the long run, boosting token value.

Anybody can become a genesis validator by running a full node to gain rewards and transaction fees. To enforce non-malicious behaviour, validators must lock up some of their INJ tokens as a stake and are subjected to possible slashing if found acting in bad faith. Your INJ is held for 21 days (unbonding) if you choose to unstake. Token holders can also stake via delegating to a validator node to earn INJ rewards. Read more here about becoming a validator.

Injective completed a partnership with NEAR Protocol to expand their multi-chain trading. They have also partnered with Harmony, Klaytn, and Ocean Protocol, to name a few. There are many other decentralized exchanges, but not many are as decentralized to such an extent as Injective. You may want to take a peek at AtomicDEX for competition from the Komodo team.

For investors, if you prefer long-term holding, Injective is well worth considering. Yes, it’s another DEX... but this one is clearly leading in many areas.

Trend Lines

INJ started trading on Binance during the month of October 2020. The daily chart below has the full trading history of the ERC20 token on that exchange. This doesn’t give us a lot of past history for analysis. However, you can see that we were able to create a downward bearish pattern from the 3 lower lows that perfectly bounced the token upward. From the previous low to the peak is a tad over 100% gain, with a large candle wick pushing it back down just yesterday. Is this the start of the bears taking control and pushing it down, or will we get 2 or more attempts to breakout?

As we zoom closer to the 4-hour candle chart for INJ/BTC pairing, we can see the upward trendlines bringing INJ over top of the resistance. Will it get a bounce of the old resistance line to make it support for another attempt to go higher? If it continues down, the next possible support could be the top of the previous high.

The Other Trend Lines

In the last couple of weeks, we have seen some altcoins becoming bullish. Buying breakouts is a trading strategy that some use. For example, ADA has gone up 71% against BTC from resistance on August 10.

AVAX broke the resistance line 6 days ago and has had gains of 161% against BTC. However, the wick on top of the last candle seems pretty long, which might be a sign that AVAX needs to take a breather.

Is BNB testing a possible breakout? Today up 14% above the resistance line. BNB has had a few longer bull runs in the past; is it ready for another?

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 359% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $43,927 and $50,500 USD in value.

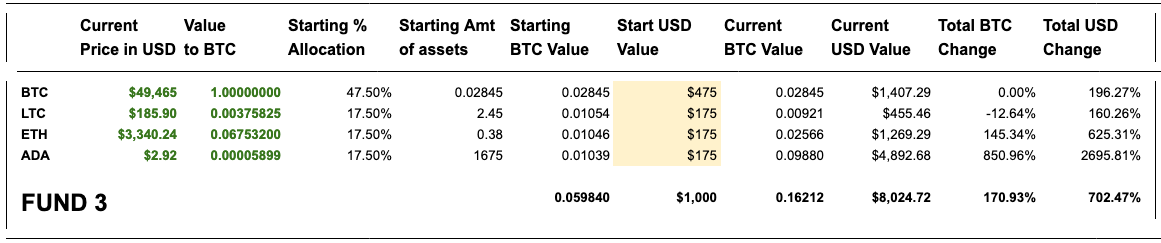

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 170% since the start. The USD fund value is up 702% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -12% against BTC. ETH is up 145% against BTC since the start. ADA has a gain of 850% against BTC and 2695% to USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 73% against BTC since the start; LINK is up 1.6%, WAVES is up 155%, XMR is up 50%. Overall, against BTC, the fund is up 70% and 53% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

Referral Sponsors

Use Netcoins as a Canadian to buy and sell BTC, ETH or LTC using Canadian dollars. Get a $10 bonus when you signup using this referral link.

Join Celsius Network using the referral code 1177858d59 when signing up and earn $50 in BTC with your first transfer of $400 or more! https://celsiusnetwork.app.link/1177858d59

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites.

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.