Internet Computer, Reimagine Everything - Issue #45

In this newsletter, we are profiling Internet Computer Protocol [ICP]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

ICP opened with a bang back in May 2021, and if you FOMOed in on the first day, you might still be in a loss. With a long roadmap and big plans, ICP can be a good digital asset to test your trading skills on.

Profiling

Internet Computer is a cryptocurrency project with the very ambitious goal of creating a viable alternative to the entire Internet stack. Started originally in 2016 as Dfinity by Dominic Williams, they launched their mainnet in 2021 and are currently presided over by the Dfinity Foundation.

The ecosystem coin, ICP, is used for trading, fees, staking and governance. It was initially released with a supply of almost 470 million and is inflationary with an annual diminishing inflation rate. The rate will drop over time from 10% to 5%.

The Internet Computer system is one of the more technically complex crypto projects. Consensus is achieved via a special type of Proof-of-Stake called Threshold Relay. Everything is managed by the Network Nervous System (NNS), which runs on a dedicated subnet of nodes. The subnet implementation is similar to the ones used on Polkadot and Kusama. Applications are written in a language called Motoko and reside on “canisters” on subnet nodes. While it does not require any fees for a user to interact with an application, the canister owner must provide “cycles” to keep their code running. You can buy cycles by converting ICP to SDR. One SDR is equal to 1 trillion cycles. Cycles are burned when used and cannot be converted back into another token. The main components of the NNS are canisters for handling the registry, the ledger, and governance. Not all of the code in the NNS is open source.

This is another ecosystem where it does not necessarily make sense to talk about transactions per second. If looking from a canister point of view, the current read rate is about 4 TPS, and the write rate is around 1 TPS. You can always add throughput to your canister by adding more machines.

In order to do anything on the Internet Computer, you must have an “Internet Identity.” This identity is created when you first run a wallet, and your same identity is used throughout the ecosystem from then on. Staking does not work as you normally expect; rather, standard monthly rewards are paid out according to the participants holding amount and region. Data centers are also paid rewards. All rewards are taken from the yearly inflation amount. The Dfinity Foundation is assumed to have the most ICP staked and for the longest time, ensuring that they remain mostly in control.

Uncommonly, Internet Computer has a very lengthy roadmap stretching for 20 years. They hope to have their ecosystem be a viable alternative to today’s Internet by 10 years and to have surpassed it by 20 years. If this came true, it would mean the end of huge corporate entities like Google, which basically control the Internet today. Although, with the NNS currently being a bottleneck for control over everything and some code being closed-source, many worry that this is just Dfinity Foundations’ attempt to overthrow Google and become king. These concerns could be removed if they decide to decentralize more in the future and eventually open-source their entire code base. It is unknown and unclear what their plans are in this regard.

Dfinity is currently working on a new operating system for mobile devices called “Endorphin.” It will run only Internet Computer applications, and there will be no distinction between websites, apps, and dapps. All items are cached when accessed, so there is no regular installation process required. It is yet to be seen if device makers will adopt this new operating system. Is this starting to sound kind of like Google with their Android OS?

There is currently not much regarding competition as Internet Computer aims at such high and lofty goals. MaidSafe also has something called the “Maid Safe Network,” which also aims to provide an alternative to the Internet and could possibly be seen as more decentralized.

If you think this new Internet sounds amazing and you are not scared of the possible new overlord, this is certainly something to be stocking up on right now.

Trend Lines

When ICP was listed on Binance on May 11, 2021, it shot up over 700% that day from its opening price. It went into a death spiral, losing 98% over the next 47 days from opening highs. Since the all-time lows set June 26th, ICP has created an upward trend pattern with as much as 65% range between support and resistance.

On the ICP/USD chart, the bottom was at $26.90, creating a double bottom. From there, it has bounced nicely to $86.98 on September 5th, 2021, for a 223% gain. Will ICP test the lower support line or will the previous tops act as support?

ICP broke the resistance of $75 and now the next major resistance is in the $100 area. We may see a retest of the support area before the next move up.

The Other Trend Lines

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 379% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week Bitcoin has been ranging between $46,512 and $52,188 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 167% since the start. The USD fund value is up 728% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is -0.25% against BTC. ETH is up 176% against BTC since the start. ADA has a gain of 788% against BTC and 2626% to USD.

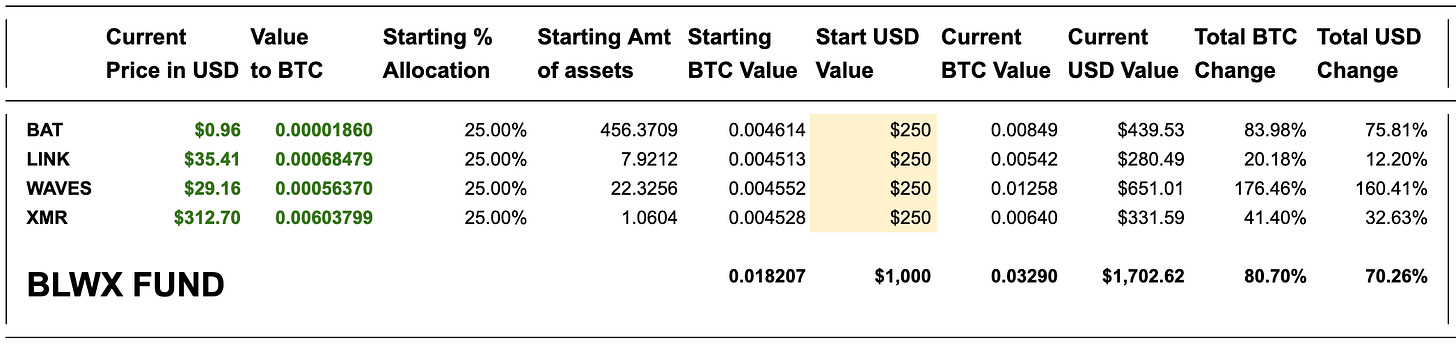

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 83% against BTC since the start; LINK is up 20%, WAVES is up 176%, XMR is up 41%. Overall, against BTC, the fund is up 80% and 70% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

Referral Sponsor

Join Celsius Network using the referral code 1177858d59 when signing up and earn $50 in BTC with your first transfer of $400 or more! https://celsiusnetwork.app.link/1177858d59

Use Netcoins as a Canadian to buy and sell BTC, ETH or LTC using Canadian dollars. Get a $10 bonus when you signup using this referral link.

Looking for a good crypto phone app that comes with a metal VISA card that rewards you for spending and staking? Check out the crypto.com wallet.

Bybit - Crypto derivatives and spot trading platform. Leverage trading up to 100x. Cold wallet storage. No KYC, just an email address to open an account. Zero maker fees and low taker fees. (Not available in US, China, Singapore, Cuba, Iran..) https://www.bybit.com/en-US/invite?ref=ZP2RNY

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites.

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.