Kadena - Issue #66

In this newsletter, we are profiling Kadena [KDA]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap, and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Ok, so Kadena is the Usain Bolt of blockchains and is not PoS, but yet it might not be the best investment unless you mine it. It is worth putting on your watch list if it breaks upwards in the charts. It currently sits at #75 on CoinMarketCap and is way behind the other top smart contract blockchains.

Profiling

Kadena is a Proof-of-Work blockchain that supports smart contracts, has super low transaction fees, and scales incredibly well. It was founded in 2016 by Stuart Popejoy and Will Martino. Together, the two worked in JPMorgan’s Emerging Blockchain group before starting Kadena to address problems with existing blockchain technologies.

Kadena is the only public layer-1 blockchain in production today that runs on Proof-of-Work consensus while being sharded and scalable. Almost all other modern blockchains are Proof-of-Stake or some variation of it. Kadena has a maximum supply of 1 billion KDA. It has been tested at an impressive 480,000 transactions per second, which is made possible by the use of multi-chain braiding technology. Transaction fees are negligible. There are currently twenty braided blockchains in the ecosystem that have their information intertwined with each other. More blockchains can be added to increase speed and scalability if required. The PoW consensus algorithm used is Blake2s, and a new block is mined every 1.5 seconds. The mining reward schedule can be seen at https://github.com/kadena-io/chainweb-node/blob/master/rewards/miner_rewards.csv. To see the block generation on any of the twenty blockchains, refer to the explorer at https://explorer.chainweb.com/mainnet.

Smart contracts run on a custom programming language called Pact which easily integrates with Javascript allowing the creation of complex applications. Pact was designed with non-developers in mind to attract mass adoption. There are tools for DeFi, NFTs, and interoperability with other blockchains. Cosmos developers can utilize a version of Pact implemented on top of Tendermint. Kadena claims that their smart contracts are very safe and secure. Smart contracts also allow staking with KDA, which is not something you ever see on PoW blockchains. Staking has not been fully fleshed out yet.

Being a Proof-of-Work blockchain that can possibly solve the blockchain trilemma is very impressive, but there remain some areas of concern. The amount of KDA being released yearly into the ecosystem may not provide the best tokenomics. The system is also not fully decentralized as the number of braided blockchains is currently controlled by the foundation, but governance is still handled by hash rate. The Blake2s consensus protocol is not ASIC resistant, meaning there will continue to be a war of mining hardware with ever-increasing power needs, just like with Bitcoin.

Regardless, many in the crypto sphere will tell you that they trust PoW consensus more than PoS; so if that is you, we recommend keeping a close eye on Kadena.

Trend Lines

On the KDA/BTC daily chart going back to May 2021, we see how it was flat till September 2021 and burst upwards in October and November 2021 with a gain of 5535% from bottom to top. Since the double tops in November, it has been in a bear trend against Bitcoin. To turn bullish from here, it needs to close above the top trend line, the 128 MA (moving average in yellow) and the previous high hit early February 2022. That would be a 33% increase from the current price, which in the altcoin world happens on a regular basis. The downside is the large amount of KDA being mined and the current bearish crypto market not helping bring in new demand. Currently, the 200 MA (in green) seems to be good support for KDA.

On this following chart, KDA is paired to USD. From the lows it hit in July 2021 to the peak reached mid-November, it gained 9481% and since then has lost as much as 84% of those gains. KDA/USD is losing good support areas as it trends lower. The 128 MA (yellow line) gave support and now is acting as resistance. The 200 MA is also acting as resistance. KDA is currently hovering around $6.19 with some support around the $5 area. Though if it hits another time or two, it may break down further.

The Other Trend Lines

According to current trend lines, we have looked at Bitcoin from many different angles and what the future is saying. The chart below is a logarithmic chart going from 2014 to 2031.

The first price comes from August 2015 when there was a flash crash on Bitfinex; at that point, it was the best exchange for trading. The price dipped down to $162. A bull run started that lasted till late 2017 when BTC reached almost $20,000.

From the highs in 2014 and 2017, we have created the Top of the Trend line. Bitcoin does seem to range more between the Bottom and Middle trend lines, and in rare cases, it hits extreme bottom and the very top.

If we were to predict where BTC ranges by the end of 2022 in this trend, the top is $717,900 but unlikely, middle at $173,860 and the bottom is $42,850. Hitting $100k+ seems pretty reasonable in 2022.

The current (March 2022) extreme bottom is at $18,370 and has reached that extreme only during the flash crash in 2015 and when the covid shutdown happened. Bitcoin has not been war tested; if the current events in Ukraine escalate, we may see how Bitcoin reacts.

Then as we look further into the future. The possibility of Bitcoin taking further market share from Gold, seeing other small countries legalize it as a currency and also individuals and institutions using it as an inflation hedge, a $1 million Bitcoin could show up as early as May 2027 and $2.5 million by November 2031. Those predictions are the bottom trend line only.

Trends also break and need to be readjusted. For example, the bottom line could act as resistance in the future or even reverse. But if current history holds, we should see a 6 figure Bitcoin at the latest early 2024.

Watch a video with Natalie Brunell interviewing Mark Moss about Bitcoin and why he left the altcoin/crypto space behind to only invest into BTC. Mark also talks about not investing your whole portfolio in Bitcoin. From the bullish side, could BTC go up 10x in the next five years? On the bearish side, if too much paper, such as futures, is placed into the market to price BTC, we could see prices that won’t increase as predicted. The demand for Bitcoin will come from where the urgency comes from, such as inflation. Several countries have high inflation where you could lose all your wealth within 2 to 3 years. Mark answers the reasons he sees higher-priced Bitcoin.

Watch a Bitcoin-only conference from the last few days that covered the lightning network, hardware wallets, understanding mining, legal issues, payment adoption, future prices and many other topics. There are two videos of 8 hours each that were streamed.

Portfolios

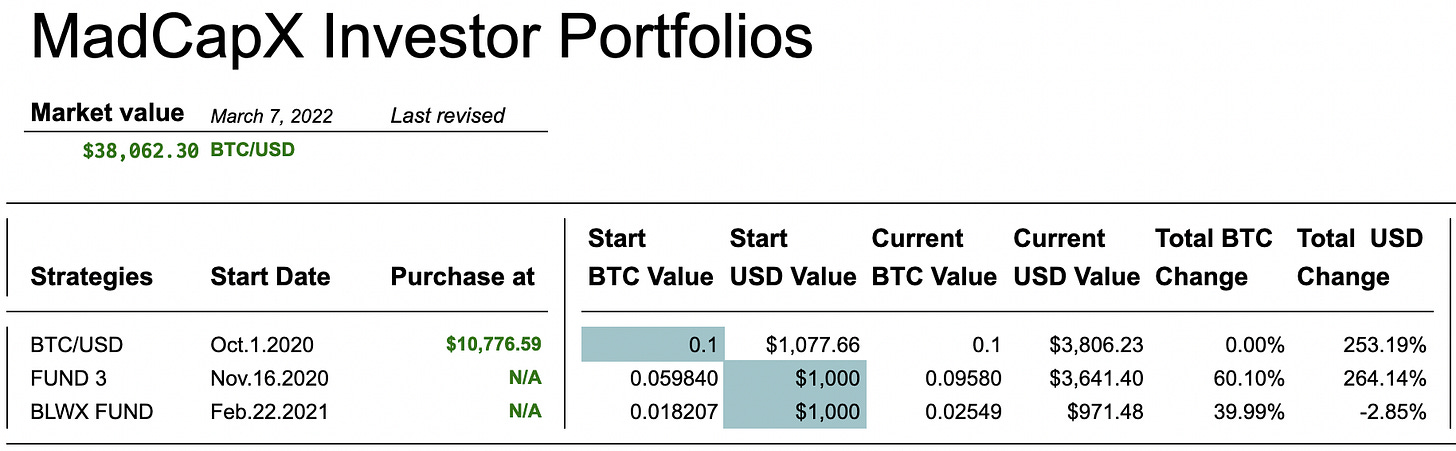

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 253% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week Bitcoin has been ranging between $37,578 and $45,400 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 60% since the start. The USD fund value is up 264% since the beginning. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -39% against BTC. ETH is up 140% against BTC since the start. ADA has a gain of 244% against BTC and 675% to USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 65% against BTC since the start; LINK is down -40%, WAVES is up 136%, XMR is down -2%. Overall, against BTC, the fund is up 40% and down -2% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

Referral Sponsors

Join Celsius Network using the referral code 1177858d59 when signing up and earn $50 in BTC with your first transfer of $400 or more! https://celsiusnetwork.app.link/1177858d59

Use Netcoins as a Canadian to buy and sell BTC, ETH or LTC using Canadian dollars. Get a $10 bonus when you signup using this referral link.

Looking for a good crypto phone app that comes with a metal VISA card that rewards you for spending and staking? Check out the crypto.com wallet.

Bybit - Crypto derivatives and spot trading platform. Leverage trading up to 100x. Cold wallet storage. No KYC, just an email address to open an account. Zero maker fees and low taker fees. (Not available in US, China, Singapore, Cuba, Iran..) https://www.bybit.com/en-US/invite?ref=ZP2RNY

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites.

Madbyte does have its own token called MADX on the Fantom and Ethereum networks and under symbol Madbyte on the Waves network. The tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.