Litentry - Issue #55

In this newsletter, we are profiling Litentry [LIT]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Many crypto projects are similar to each other, but Litentry brings something unique to the table in its quest to decentralize identity information. It is currently at #417 on CoinMarketCap with good potential to move up the ranks.

Profiling

Litentry development was started in 2018, with the LIT ERC20 and BEP20 token launching on Binance Launchpad earlier this year. Its founder is blockchain developer Hanwen Cheng, who saw the future need to be able to prove identities in a decentralized manner. Litentry thus is a cross-chain decentralized identity provider and authenticator as well as activity management tracker.

The LIT token was created with a maximum supply of 100 million, with 15% going to the development team, 12% to private sales, 17% to the Litentry foundation (to be used for grants), 8% to seed investors, 3% to pay for Binance launchpad, and finally a whopping 45% for network incentives.

Litentry is built on the Substrate, a very popular cryptocurrency framework that will allow for cross-chain interactions. See https://substrate.io/ecosystem/projects/ for all the coin ecosystems that have utilized Substrate. Litentry is “Ready for Polkadot” and is currently vying for a chance to become a Polkadot parachain. If and when this happens, the future could be very bright for Litentry indeed.

The LIT token is used to pay for fees, of which there are several: transaction fees, matching fees, and validation fees. Identity validators (or “Identity Guardians”) are chosen at random to provide validation and get paid rewards in LIT. Guardians that provide bad validations can be punished in the form of getting their staked LIT slashed. Governance will also be available to LIT stakers, allowing them to vote on future updates to the system as well as permanently removing Guardians that continue to be dishonest. Grants provided via the Litentry foundation will be used to entice developer adoption. The eventual inflation rate goal is 5% annually. Rewards and grants will not start to be given out until November of 2025, at which point the ecosystem should already be in a completely working and robust state.

Any other cryptocurrency ecosystem will be able to utilize Litenty decentralized identifiers (DID) to expand their DeFi services in a decentralized and secure way instead of resorting to centralized identity solutions. Users can currently have an account on the Litenty mobile app, which can then be linked to other networks and even other identity services. Data can be shared across networks using private keys without the user’s personal information being divulged. This kind of service is essential because there are limitations to how far DeFi can go without identity verification. For example, currently, all DeFi loans are highly over-collateralized. If you could verify a credit score, as Litentry allows you to do, extra services could be offered without super high collateral. In political scenarios, DIDs can be used to ensure fair and accurate representative voting. For airdrops, instead of sending to unique wallet addresses, you could send to unique identities.

The Litentry SDK currently allows development in Javascript, with more languages possibly added in the future. The SDK provides developers with functions to interact with the state on Litentry and user identity data related IPFS storage.

Litentry currently has no direct competition as there are no other cryptocurrencies with a focus on decentralized identity aggregation. Hopefully, with the head start they have and the upcoming parachain, they will continue to be the leaders in this area.

Trend Lines

LIT/BTC pairing on the daily chart going back to February 2021, when it was launched on Binance, has been heading mainly sideways. In May 2021, it dropped 50% and has moved sideways since then. The current range is 82%, from support line to resistance.

LIT/USD pairing on the daily chart shows us that the all-time low ($0.25) and high ($24.68) were made within a day of each other. Currently, LIT is slightly over $4 USD. The current pattern seems to be in an ascending triangle.

This video below, at about the 16-minute mark, gives a case for a 426% rise for LIT to about $23.

The Other Trend Lines

Bitcoin hit an all-time high of $69,000 USD very recently on November 10, 2021; since then, it has corrected about 19% and could see some more downside in the near future if $55,600 does not hold. There is good support between $52,600 and $53,000. With the current correction, reaching $100,000 by the end of the year is becoming more unlikely now, and we could assume the 1st quarter of 2022 becomes a more likely time frame.

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 420% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $55,600 and $63,617 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 97% since the start. The USD fund value is up 562% since the beginning. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -13% against BTC. ETH is up 164% against BTC since the start. ADA has a gain of 408% against BTC and 1594% to USD.

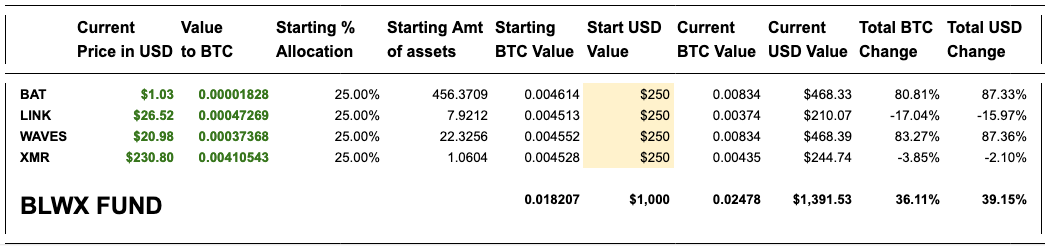

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 80% against BTC since the start; LINK is down -17%, WAVES is up 83%, XMR is down -3%. Overall, against BTC, the fund is up 36% and 39% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

Referral Sponsors

Join Celsius Network using the referral code 1177858d59 when signing up and earn $50 in BTC with your first transfer of $400 or more! https://celsiusnetwork.app.link/1177858d59

Use Netcoins as a Canadian to buy and sell BTC, ETH or LTC using Canadian dollars. Get a $10 bonus when you signup using this referral link.

Looking for a good crypto phone app that comes with a metal VISA card that rewards you for spending and staking? Check out the crypto.com wallet.

Bybit - Crypto derivatives and spot trading platform. Leverage trading up to 100x. Cold wallet storage. No KYC, just an email address to open an account. Zero maker fees and low taker fees. (Not available in US, China, Singapore, Cuba, Iran..) https://www.bybit.com/en-US/invite?ref=ZP2RNY

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites.

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.