Making Waves - Issue #7

In this newsletter, we profile the Waves blockchain. It has seen gains as much as 1500% in 2020. BTC and ETH get most of the news, but can Waves be a potential competitor to Ethereum and other up-and-coming blockchains?

The Short of It

Waves is similar to Ethereum in that you can build any sort of smart contract. It has a good ecosystem but not nearly as large as that of Ethereum. One big factor that makes Waves a winner is that it has no transaction fees, but is that enough?

Portfolio

This portfolio section gives you an idea of what sort of return you can get when investing in cryptocurrencies. Over time, we will introduce other portfolios with different crypto assets.

The BTC Hold is up 76% since October 1st, 2020. Since this is a long term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long term hold position as our best stable alternative. As a note, when trading one asset to another asset, it could create a tax event that should be reported in your income taxes in several countries. Being a long term “hodler” has advantages.

The BTC/USD fund is up 39% since November 2nd but is down a couple of percentage points from last week when BTC hit all-time-highs over $19,800. This past week bitcoin has been ranging between $18,000 and $19,600 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH and ADA. The BTC value has dropped from last week’s 10% to 7.7% gain since starting. Against USD, it is up 23% since the start. We will hold these positions to see how well it does against our BTC-only portfolios. LTC hit the top bearish trendline on November 24th and continued to get rejected a couple more times and now is trending down and is now only 1% BTC gain. ETH continues going down for the second week against BTC but still looking promising to break upwards; ETH is up 12% against BTC since the start. ADA is up 30% since the start but down from 40% last week against BTC.

Profiling

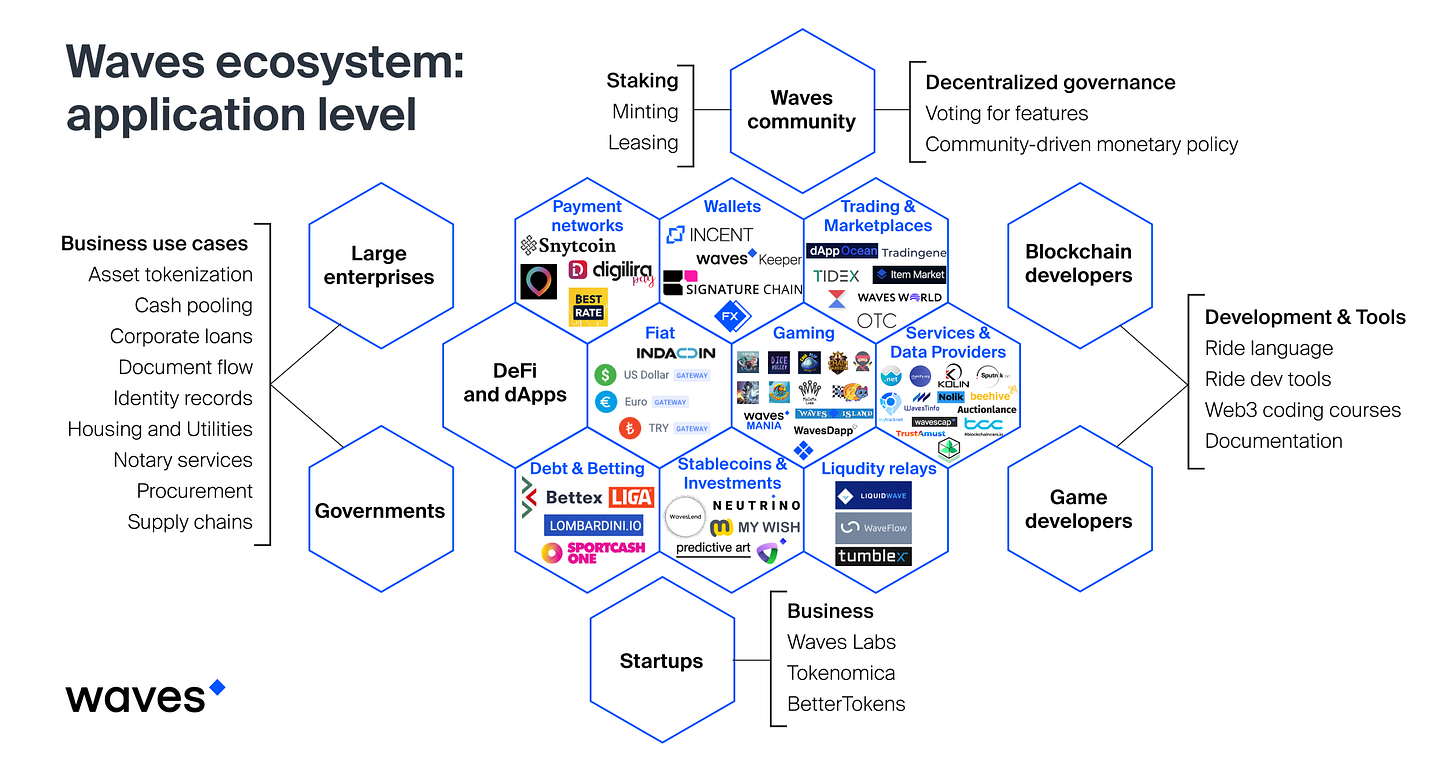

Waves was created by technology entrepreneur Sasha Ivanov and launched in 2016 with a focus on decentralized applications. It has since grown in scope and now has the capability for writing smart contracts in a language called Ride, a built-in decentralized exchange and the Wave Matter system added for enterprise use. Interoperability is gained via Gravity Protocol hubs (to allow cross-chain transactions and oracles) and the Band Protocol partnership. The main competition to Waves is probably Polkadot and Cosmos.

The Waves blockchain has 1 minute block times and utilizes Leased Proof of Stake (LPOS). To be able to stake, you must hold a minimum of 10,000 WAVE. Stakers are paid in Miner Reward Tokens (MRT), which can be exchanged. There is no maximum monetary supply, and inflation is determined by decentralized community voting regarding staking reward amount. There is a rule in place to limit inflation to a maximum of 8.5% per year. So far, the trend has been approximately 5% inflation per year.

You can view the many dapps that have been developed via https://dappradar.com/rankings/protocol/waves. Upon closer inspection of that list, it becomes clear that while there are a lot of dapps, there is not currently much activity on them. Will adoption increase over time? This Medium article is an excellent resource for learning to build your own dapps.

Waves Enterprise addresses the needs of corporate endeavours, which often require control of their own centralized blockchain eco-system. The blockchain agnostic Gravity Protocol allows for true cross-chain communications with a no-token cost approach.

The Neutrino protocol provides an interchain toolkit for frictionless decentralized finance (DeFi) on demand. It utilizes the stablecoin USDN and allows for easy creation of custom stablecoins pegged to specific real-world assets.

Waves is a great platform with a ton of potential, and unlike many other blockchain systems, it is ready for use right now. Now it’s a matter of adoption and usage.

Trends

On this first chart with WAVES/BTC pairing using the weekly time frame, we see Waves bottoming out in December 2019 at 0.0000714 satoshis. Since then, the trend has gone bullish, with the latest high this week at 0.0004867. That is over 550% gain on BTC. A crypto asset that has been around for so many years in the top 100 and having such a significant gain is good news for longtime holders. It now is at a point where it may have a pullback. However, history shows that Waves has had several huge upward swings.

In this second chart pairing of WAVES/USDT, it hit a low in March 2020 of $0.55 when most all trading assets took deep dives. Such as oil futures going negative $40, gold hitting yearly lows, and BTC going below $4000. The Waves chart looks similar to the high flying TSLA stock that is up almost 800% from March, though Waves has a gain of over 1500% in the same time.

We do know that some smaller ERC20 tokens that are on Ethereum have made the jump to Waves. The Defi craze on Ethereum has made it almost impossible for the smaller guy to work with it since the fees have skyrocketed.

Waves is the 3rd best-performing cryptocurrency in the top 100 in the last 7 days—up over 30% with Sushiswap and NEM taking first and second.

Another take on Waves and its ecosystem is a must-listen-to video by Coin Bureau YouTuber explaining what Waves is and the several other parts such as Waves Enterprise, Gravity hub use-cases, Band protocol partnerships and Waves tokenomics. It ends with the fact that there is not very much activity in the Waves ecosystem as of yet.

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This newsletter is a paid subscription and supports the team and the Madbyte projects. Subscribe and get access to our archives.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.