Melos Studio - Issue #71

In this newsletter, we are profiling Melos Studio [MELOS]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap, and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

With thousands of tokens spread out on Ethereum, Binance and other networks, we don’t normally cover a token that is ranked so far back of the top 100. MELOS is #2908 on CoinMarketCap. Is it something worth adding to your watchlist?

Profiling

Melos Studio was founded in 2020 and launched earlier this year by Lin Yalu with the aim of being a decentralized music Web3 collaboration platform for musicians and music creators. The system allows you to capture musical moments on the blockchain utilizing non-fungible tokens (NFTs).

The ecosystem's token, MELOS, resides on the Ethereum (ERC20) and Binance (BEP20) blockchains. MELOS has a total supply of one billion and is used for both utility and governance purposes. 300,000,000 of those tokens will be released over a ten-year span as rewards for staking and active participation. For a full breakdown of their token distribution, please refer to their whitepaper.

While a lot of the features of the system are still in development, you can already apply to be a platform musician to be able to upload your creations and have them appear in the marketplace. These uploads or creations are forged as NFTs called MusicBlocks. They can be forged in three different ways: New Forge (brand new original content), Solo Forge (modification of an existing MusicBlock), or Jam Forge (merging or blending of two or more MusicBlocks). Each MusicBlock has “DNA,” which retains information about its origin and other important data for tracking purposes. MusicBlock creators can define the pricing and usage parameters of their contributions. For example, if artist “B” were to purchase a MusicBlock from artist “A” and use it in a Jam Forge to create a new MusicBlock, artist “A” would get royalties from sales.

The website contains a number of sections which show as being under construction, but elements like the Marketplace are up and running. A music creation workshop called Metis is available for testing in an alpha state. This will eventually allow the creation of MusicBlock NFTs right from the workshop page, substantially lowering barriers to entry into the space.

Melos is governed by a decentralized autonomous organization (DAO), which allows members to vote on proposals and implementations coming to the platform. DAO voting rights require a minimum of 1000 MELOS to be held, with voting weight going up depending on the total MELOS being held.

Melos Studio is one of the first to make its way into the music creation niche of the ongoing NFT craze. If you are a musician interested in getting started with NFTs, this may be an excellent opportunity to get in early.

Trend Lines

This chart on MELOS/USDT goes back only two months to March 17, 2022. So we don’t have too much history to work with. The first day the price was all over the place, so we will not use those lows or highs. The high of $0.43 set a few days after opening on Kucoin gives a better place for our trend line to start from. Over the past two months, the price has lost 82%, with the lows hitting $0.073 just a few days ago. From those lows, it has shot up 57% over a two-day period. If MELOS doesn’t break the top of the trend line, there could very well be even a lower low. If you are day trading this asset, there are opportunities for good gains.

Find MELOS on Kucoin, Bybit, LBank and a couple of other exchanges. LBank seems to have the best volume at the time of writing.

The Other Trend Lines

Here is a chart from a TradingView user on Bitcoin

Recently I made an analysis on Bitcoin and my expected final capitulation area. Said capitulation area would, in my view, be likely be the bear-market low. For now, we found strong support around the $29k support, the same area which held during the summer-21 bear market. Since the stock markets have been selling off for 6 straight weeks, it's statistically likely that stocks will end up in the green next week, which will likely lead to a green week for BTC as well. In my view, this is just a dead-cat bounce which will eventually lead to further capitulation towards the 200-week SMA . Enjoy the bounce, but be careful since there's likely more downside coming.

How a professional trades the next weekly Bitcoin candle.

Bitcoin is at a range low with the break of 30k potentially being a fakeout. Probability still favours bullish extraction of the range especially if the weekly candle closes as a hammer candle. The three patterns (marked 1 / 2 / 3) are potentially patterns that may emerge which will give more probability towards certain paths for future price action.

Probability is the priority of the professional trader. They will NEVER care about catching the "top" or the "bottom" of a move or getting a x100000 home run if it was not done with an understanding of the probability (and risk) behind your trade. Translating this to laymen terms - if you are buying when bitcoin is in the process of selling off and UST is blowing everything up without more thought than "It can't sell off much more!" you are not trading you are gambling and you WILL lose more money than you earn over the course of your life. That is not an opinion - it is a statistical fact.

Professional traders are professional because over the course of their lifetime/thousands of trades, they are able to consistently win. Just like a casino, it doesn't matter how much they win in each trade but if they are consistent in returning profits and can make a regular income from trading. That is it. There is no difference between you and them other than their understanding of when to take a trade because the probability is on their side and when to not get involved. (and of course their understanding of risk but I will touch on that in a post about risk in the future).

But how do they figure out probability?

A mix of experience, technical analysis and macro-economic sense all combined under the roof of emotional control. So lets work through these factors in relation to Bitcoin above.Read the rest by following this link.

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 175% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $26,700 and $32,658 USD in value.

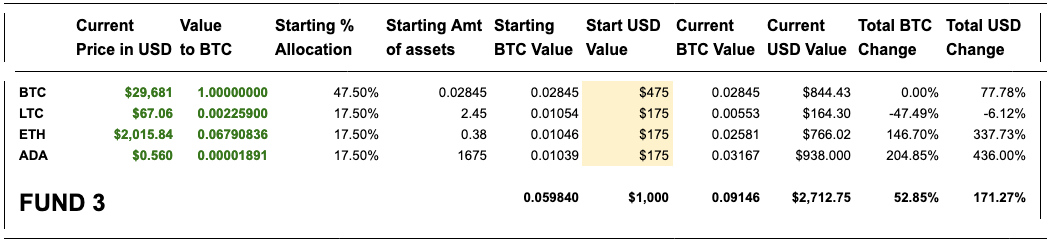

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 52% since the start. The USD fund value is up 171% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -47% against BTC. ETH is up 146% against BTC since the start. ADA has a gain of 204% against BTC and 436% to USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 31% against BTC since the start; LINK is down -56%, WAVES is up 8%, and XMR is up 32%. Overall, against BTC, the fund is up 4% and down -43% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

Referral Sponsors

Join Celsius Network using the referral code 1177858d59 when signing up and earn $50 in BTC with your first transfer of $400 or more! https://celsiusnetwork.app.link/1177858d59

Use Netcoins as a Canadian to buy and sell BTC, ETH or LTC using Canadian dollars. Get a $10 bonus when you signup using this referral link.

Looking for a good crypto phone app that comes with a metal VISA card that rewards you for spending and staking? Check out the crypto.com wallet.

Bybit - Crypto derivatives and spot trading platform. Leverage trading up to 100x. Cold wallet storage. No KYC, just an email address to open an account. Zero maker fees and low taker fees. (Not available in the US, China, Singapore, Cuba, Iran..) https://www.bybit.com/en-US/invite?ref=ZP2RNY

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites.

Madbyte does have its own token called MADX on the Fantom and Ethereum networks and under the symbol Madbyte on the Waves network. The tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.