NEAR Protocol - Issue #61

In this newsletter, we are profiling NEAR Protocol [NEAR]. In previous newsletters, we have profiled Bitcoin, Cardano, Fantom, Solana and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Once again, we are reviewing an Ethereum competitor that is relatively new with plenty of chatter in social media. NEAR has enjoyed a bull run since launch and is worth paying attention to.

Profiling

The NEAR Protocol mainnet launched in 2020. It was founded by Wall Street entrepreneur Erik Trautman and developer Alexander Skidanov. The ecosystem's primary focus is to provide a modern, fast, scalable, and cheap platform for decentralized applications. NEAR is their native utility token.

NEAR had a launch supply of one billion tokens and can theoretically handle up to 100,000 transactions per second at nearly instant finality. This is achieved via a one-second block creation speed. Consensus is provided by a Proof-of-Stake variant called Doomslug. Scalability is provided by Nightshade sharding. The NEAR coin is used to pay transaction and processing fees, staking rewards, and governance. There is a yearly 5% increase in token supply, of which 90% goes to staking rewards for validator nodes. 30% of the transaction fees are paid back into the system, while the remaining 70% are burned.

You can stake your NEAR easily by delegating it to a validator node. You also have the option of running your own validator node, but it requires the purchase of dedicated hardware to become a “Chunk-only Producer” node. There is also to rent a pre-setup cloud node which has the benefit of being easier to maintain as upgrades are handled automatically. To qualify for running a node, you need to complete a Validator Bootcamp program.

Developers can build smart contracts on the blockchain using the Rust language. Developers also get 30% of the processing fees when someone runs their contracts. There are handy bridges available for easy transfer of tokens from other ecosystems like Ethereum or Polkadot. Complete documentation for how to develop applications and mint NFT’s is available in their docs. Developers can get started quickly by using the cloud-based NEAR development environment set up specifically by the NEAR core developers on Gitpod.

Competition to NEAR is all other fast and scalable layer-one smart contract blockchains. Like for every other contender, the main competition is still the slow, non-scalable, and expensive Ethereum blockchain. Unless Ethereum manages to drastically increase performance and fix its myriad problems with v2, undoubtedly, one of these new blockchains will take its place. Perhaps it will be NEAR.

Trend Lines

In our first chart, we pair NEAR to BTC. On this daily candlestick chart going back to October 2020, NEAR bottomed out on January 8, 2021, at 3530 satoshis and peaked just a few days ago on January 14, 2022, at 47747 for a 1250% gain against Bitcoin.

When we zoom in to a 4-hour chart still paired against BTC, there was a 3.5 month sideways trend till it broke upward just before Christmas, December 22, 2021. NEAR has been in an upward trend for the last 39 days, with the previous run gaining a healthy 50%. Over the previous three days, it has been trending sideways. The bottom support of this bull trend is 14% lower or else nine days more sideways. Currently, it is smack in the middle of the support and resistance.

Next is NEAR/USD on the weekly chart. The lows were in November 2020 at $0.51, and the highs were hit last week at $20.75 for a gain of 3967% against the US dollar. As you can see, NEAR has been in a bull run since launch.

NEAR is in an Ascending Channel and The Price is now Right at The Top of The Mentioned Channel The Price Shall Fall From Here & we Expect It To Touch The Support Levels Which we Drawn On The Chart. The Middle Line of The Channel Can be a Good Support (MInor Support) There is a Regular Bearish Divergence (-RD) On MACD as Well which Strengthen This Bearish Prediction. There is also a Slight Chance That It Would Fall to It's Major Support as Well. The Price Movement might Be Like what's drawn on The Chart. — TradingView user TT.Treetrader

The Other Trend Lines

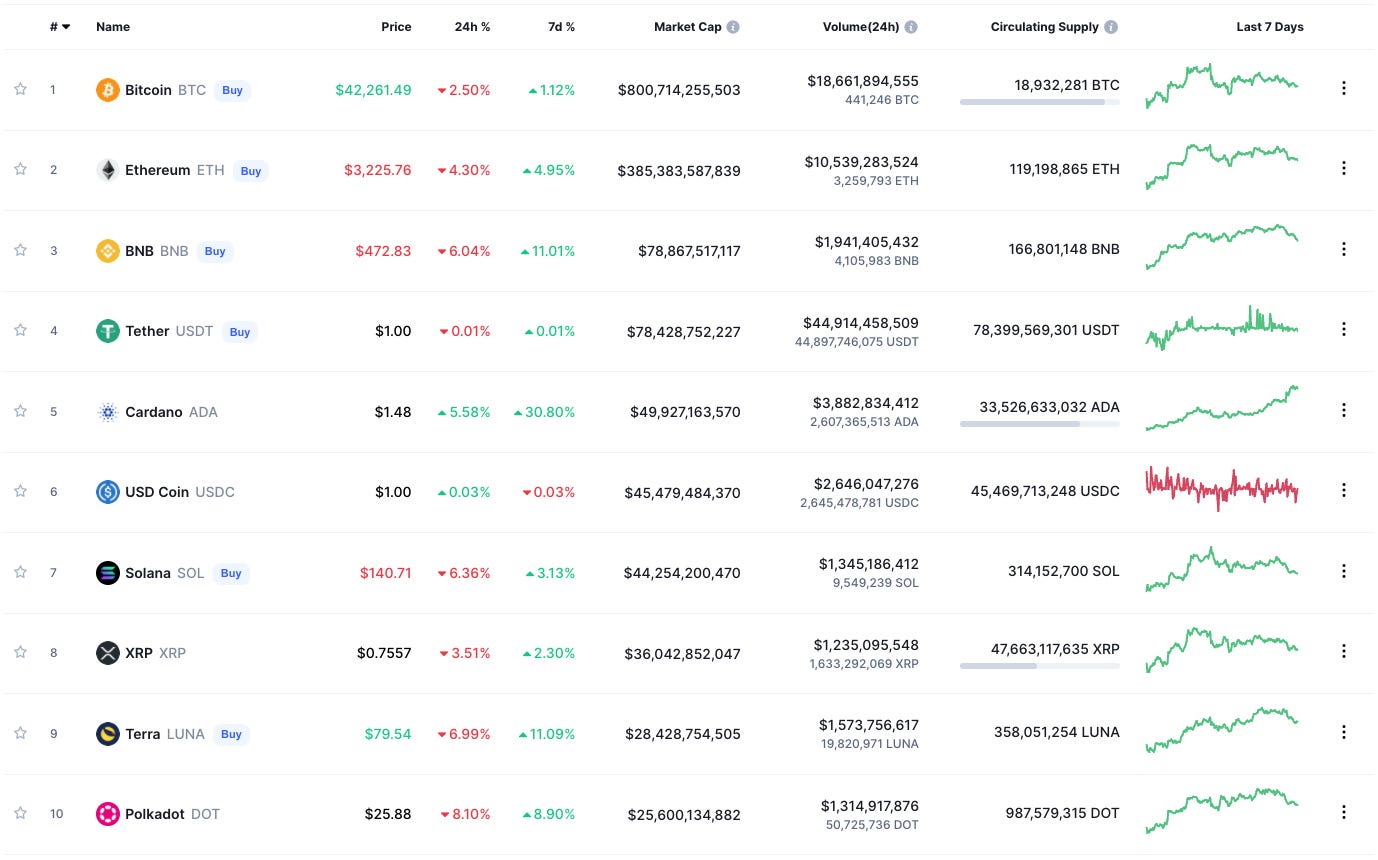

The top 10 on CoinMarketCap gained in value over the last seven days, with Cardano [ADA] as the biggest gainer at 30% and is now in 5th place, overtaking Solana.

Though when we look at the ADA/USD chart, we can see that ADA has been in a downward trend since September 2021. ADA is testing the top of the trend line. If it successfully breaks through, ADA has a good chance of having even more significant gains than in the last week. From the lows eight days ago to the peak today, it has gained 47%. There are three different lines of resistance that the daily candle needs to close above the previous high on December 27, 2021, of $1.51. The top trend line is at $1.56, and if we get a candle close above that, ADA has a hopeful chance of continuing upward. The following trend line is a weaker one at $1.67. If we get over these, we could see ADA at $2 soon after and then hopefully heading toward $3, and that would be a 100% gain from today. If we bounce down from this resistance, look for ADA to go back down to $1 again, where it has found great support since March 2021 several times.

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 290% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $41,268 and $44,500 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 83% since the start. The USD fund value is up 427% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -24% against BTC. ETH is up 176% against BTC since the start. ADA has a gain of 330% against BTC and 1326% to USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 136% against BTC since the start; LINK is down -29%, WAVES is up 63%, XMR is down -5%. Overall, against BTC, the fund is up 41% and 18% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

Referral Sponsors

Join Celsius Network using the referral code 1177858d59 when signing up and earn $50 in BTC with your first transfer of $400 or more! https://celsiusnetwork.app.link/1177858d59

Use Netcoins as a Canadian to buy and sell BTC, ETH or LTC using Canadian dollars. Get a $10 bonus when you signup using this referral link.

Looking for a good crypto phone app that comes with a metal VISA card that rewards you for spending and staking? Check out the crypto.com wallet.

Bybit - Crypto derivatives and spot trading platform. Leverage trading up to 100x. Cold wallet storage. No KYC, just an email address to open an account. Zero maker fees and low taker fees. (Not available in US, China, Singapore, Cuba, Iran..) https://www.bybit.com/en-US/invite?ref=ZP2RNY

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites.

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.