Polkadot Shorts - Issue #6

As we profile Polkadot this week, BTC is attempting to break through its high set in 2017. How does this affect other crypto projects as Bitcoin is drawing all the news and excitement? We will look at BTC a little further in the newsletter but first to the Polkadot shorts (pun intended).

The Short of It

Polkadot could challenge the Ethereum network in the coming future as one of the many blockchains attempting to unseat it as the second most valuable crypto asset. Does it have the tech and the capital to get it there? With Ethereum taking more time than initially anticipating to get ETH 2.0 launched, is that enough for the likes of Polkadot to get in front of the curve. They aren’t the only ones trying but will they be the one?

Portfolio

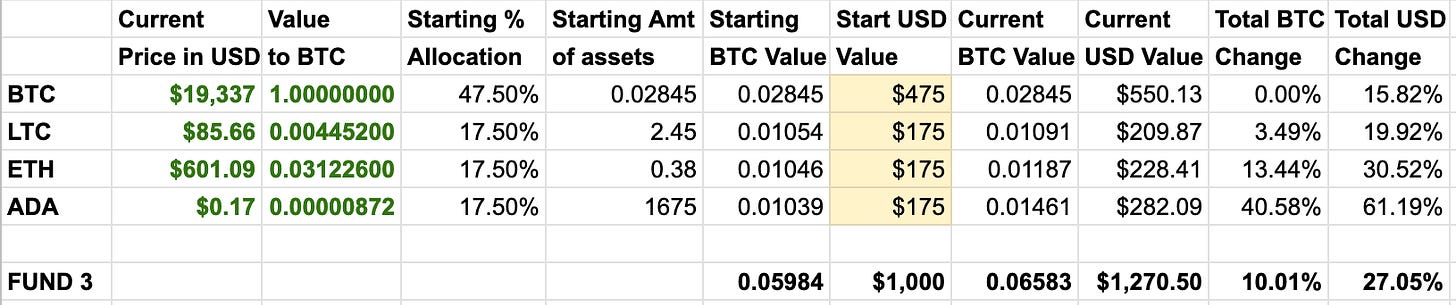

This portfolio section gives you an idea of what sort of return you can get when investing in cryptocurrencies. Over time, we will introduce other portfolios with different crypto assets.

The BTC Hold is up a whopping 79% since October 1st (that is only 2 months). This will be a long hold, and it is best kept in cold wallet storage or a safe custody solution.

The BTC/USD fund is up 42% since November 2nd. This will stay on an exchange. We will be keeping a close watch on the weekly charts to see trend changes for a trade out of BTC to USD. BTC has broken above $19,800 USD today, which is about the same as the highs in 2017. On Nov. 26th, there was a drop below $16,600 for a chance to buy the dip.

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH and ADA. The BTC value is unchanged from last week with a total gain since starting of 10%, and against USD, it is up 27%. We will hold these positions to see how well it does against our BTC-only portfolios. LTC was trading at yearly lows when bought. ETH is slightly down against BTC from last week but still looking promising to break upwards. ADA has once again performed the best with gains of 40% against BTC and 61% against USD.

Profiling

The Polkadot network was launched in May of 2020 by the Web3 Foundation (development by Parity Technologies) using Proof of Authority, which was transitioned to Nominated Proof of Stake shortly afterward. During the first year, transaction consensus will be reached by a group of one thousand nominated validators. The most exciting feature is the ability to facilitate cross-chain communication and interoperability by connecting differing blockchains.

The core blockchain is called the Relay Chain (with tokens having ticker DOT) with a number of sharded blockchains called “parachains.” Initially, there was a total supply of one billion DOT, and there will be an estimated 10% yearly inflation rate because of staking rewards. Cross compatibility with different blockchains utilizes a parachain called the “bridge parachain.” Communication between differing blockchain is achieved by a protocol called Cross-chain Message Passing (XCMP). If you are interested in creating your own smart contracts or parachains (written in Rust), check out substrate.io.

The Polkadot network will generate a new block approximately every six seconds. Staking rewards are given once a day. They are recorded per session (about four hours) and calculated per era (every twenty-four hours).

Governance is handled on-chain, with all proposals ultimately passing through a public referendum. Upgrades are designed to be forkless, so you do not need to worry about chain splits. Scalability is provided by sharding and the whole concept of parachains. Development is still ongoing, and the system will not be fully functional until governance enables parachains and XCMP.

Kusama (KSM) is a cousin network, built on the same underlying code and technology but is meant to be used as a testing, experimentation and quick development platform. It is used as a pre-production environment for Polkadot.

One of the co-founders, namely Gavin Wood (a former Ethereum developer), does not have the best trust/security history. In 2017, he lost almost one hundred million worth of Ethereum, which was slated to aid in the development of Polkadot. This was because of the accidental deletion of code libraries of the Parity wallet, which held the ETH. However, according to the Web3 Foundation, this did not hinder the progress of Polkadot.

If you are interested in an eco-system that is developing at a faster rate than Ethereum with similar technology, and in many ways better, Polkadot is definitely worth keeping an eye on.

Trends

BTC has hit ATH (all-time-high) on several exchanges today. In the last year, the landscape of who is investing has changed dramatically. Grayscale Investments have purchased over $8 billion worth of Bitcoin for their Bitcoin Trust that is available through GBTC.

Paypal bought up to 70% of all newly minted BTC in the last 4 weeks, according to an estimate by Pantera Capital. Then there is Galaxy Digital, Square, MicroStrategy and other public companies who have placed some or most of their cash holdings into BTC. Take a look at MicroStrategy’s stock price since the investment.

MicroStrategy over the last ten years, since they invested in BTC, has seen their stock go up about 200%.

We are going into a perfect storm with this Bitcoin halving cycle that includes better scaling than in 2017, Fed money printing that is happening worldwide, population moving from cash to digital in a big way, and finally, institutional investments entering.

If you are an investor into altcoins during this Bitcoin run-up, you will most likely see your investment grow against USD but not necessarily against BTC. This first chart shows BTC/USD. Over the last couple of months, it has almost doubled in value from September of 2020.

Polkadot has minimal history to base good analysis on, but we can still make this comparison in the short term. This second chart is based on the daily, going back three and a half months. DOT against BTC has been bearish for the last three months losing over 50% from its high in early September. However, this is common for the majority of altcoins while Bitcoin rises.

Here in the third chart, the timeline is the same, but DOT is paired to USDT. So you see, the investment has stayed very steady between the $4 to $6 USD range. For DOT to be a great investment, it needs to break the bearish cycle downward against BTC.

Polkadot does have a great track record in raising funds. In July 2020, they had their third raise of over $40 million selling DOT for BTC. With BTC going up in value, that war chest will increase in value. Their road map is very promising tech-wise, and investors are keen to fund them for several rounds.

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This newsletter is a paid subscription and supports the team and the Madbyte projects. Subscribe and get access to our archives.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.