Stacks - Issue #62

In this newsletter, we are profiling Stacks [STX]. In previous newsletters, we have profiled Bitcoin, Fantom, AAVE, Polkadot and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

As we review Stacks as a potential opportunity for your watchlist, the markets are in a pretty good-sized correction across both traditional and crypto-assets. So if you are even part Bitcoin maximalist, you will want to look further into Stacks as it offers some exciting potential and still is in a bull trend.

Profiling

Stacks started life as Blockstack in 2017 but later rebranded and launched their v2 mainnet in January of 2021. It was created by Princeton University computer scientists Muneeb Ali and Ryan Shea. Stacks enables smart contracts, NFTs, decentralized finance and applications for Bitcoin.

The Stacks blockchain is unique in that it is pegged to the Bitcoin blockchain. It has its own utility token, STX, used to pay the fees for all of the transactions in the network. STX holders can also stake their tokens (called “Stacking”) to assist with consensus and earn Bitcoin as a reward. Using this system, Stacks scales independently of Bitcoin. There is a maximum supply of a little over 1.8 billion STX, with around 1.3 billion currently in circulation. A total of 1,000 STX per block will be released during the first four years, decreasing to 500 STX/block in the following four years, 250 STX/block in the next four years, and finally 125 STX/block after that in perpetuity. STX is the first cryptocurrency approved by the SEC for sales offering in 2019.

Consensus is pegged to Bitcoins Proof-of-Work as well as having their own Proof-of-Transfer (PoX), making it a hybrid system. Stacks offer microblocks, which allow transaction confirmations of only a few seconds. The ecosystem contains miners and stackers. Miners offer bids of Bitcoin to be able to determine the next block and get newly minted STX along with transaction fees as a reward. Stackers verify the blocks and, in turn, get rewarded with Bitcoin. The more STX stackers hold, the more Bitcoin they can earn.

The smart contract programming is done using a language called Clarity, which is also used in the Algorand blockchain. This essentially allows developers to create tokens, NFTs, and applications that are very stable and secure because of being pegged to the Bitcoin blockchain. It also has built-in privacy. Apps are not able to see, access or track your activity, and all data is owned by the user instead of the application. Apps are open and modular, which means you can quickly build on top of other apps. Millions of smart contracts can be represented on a single hash stored on the Bitcoin blockchain, making execution fees near-zero.

While the number of businesses utilizing Stacks is still relatively small, it is growing quickly. Just a year ago, there were only a handful of companies using it, while now that number is over fifty. Later this year, Stacks will integrate Orbit Chain, a cross-chain interoperability protocol that will help with adoption.

While Lightning could be seen as a competitor, it is a layer-2 system for Bitcoin, helping scale payment transactions. Stacks, on the other hand, is layer-1 and is designed to generate more use cases for Bitcoin via smart contracts. If you love the original Bitcoin as well as smart contract ecosystems, it is definitely worth your time to check out Stacks.

Trend Lines

This first chart has STX/BTC pairing on the weekly. The bullish trend that STX that started February 2021 peaked last week with a gain of 547%. From that peak, STX is down 48% within a few days. The whole crypto market has taken a deep dive down, bringing STX close to the bottom of the support trend line. It could be an opportunity if the crypto market has found a bottom.

The following chart has STX/USD paired with a similar trend line but with a much more significant gain since the start of the bull trend. From bottom to top, there was a gain of 2438%. On the USD pairing, the bull trend started way back in November 2020; that is when BTC began an upward trend pushing the crypto market with it.

Last week this was the analysis for STX before we took the wipeout. This is from a TradingView user called TradingShot.

Stacks has been trading within a long-term Channel Up since the start of 2020 and is about to form a 1D MA50/ MA100 Bearish Cross. This is similar to the Bearish Cross of October 10 2020, which was the cross that paved the way for a 3 month rally. The 1D LMACD sequence between the two fractals is also identical. We should be expecting a bullish break-out by the first week of February.

The Other Trend Lines

Bitcoin has lost 48% from its peak back in November when it hit $69,000 and currently trading at $35,910. This chart gives you some perspective on the bullishness since early 2019. From March 2020, if we measure from the solid part of the candlestick to today, we are still up 576%. We continue inside the bull trend line even with this panic selling.

The Mayer Multiple points to a potential time to start buying into Bitcoin if history repeats itself.

The average Mayer Multiple since the creation of Bitcoin is 1.42 and currently it is at 0.74

The Mayer Multiple was created by Trace Mayer as a way to analyse the price of Bitcoin in a historical context. It does NOT tell whether to buy, sell or hold. The Mayer Multiple is the multiple of the current Bitcoin price over the 200-day moving average.

Simulations performed by Trace Mayer determined that in the past, the best long-term result were achieved by accumulating Bitcoin whenever the Mayer Multiple was below 2.4. Since the simulations were based on historical data, they are purely educational and should not be the basis of any financial decision. — from Mayer Multiple

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 236% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week Bitcoin has been ranging between $32,917 and $43,505 USD in value.

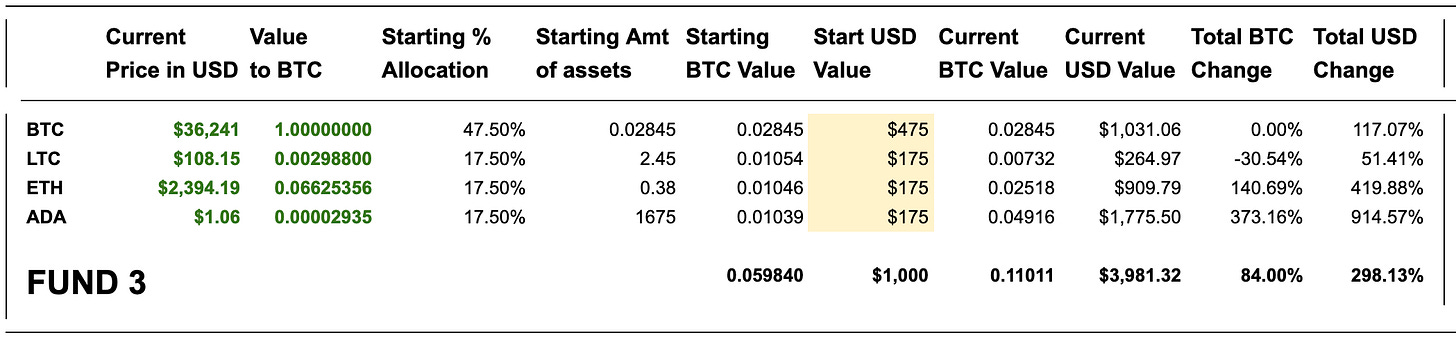

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 84% since the start. The USD fund value is up 298% since the beginning. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -30% against BTC. ETH is up 140% against BTC since the start. ADA has a gain of 373% against BTC and 914% to USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 100% against BTC since the start; LINK is down -29%, WAVES is up 11%, XMR is down -6%. Overall, against BTC, the fund is up 19% and down -9% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

Referral Sponsors

Join Celsius Network using the referral code 1177858d59 when signing up and earn $50 in BTC with your first transfer of $400 or more! https://celsiusnetwork.app.link/1177858d59

Use Netcoins as a Canadian to buy and sell BTC, ETH or LTC using Canadian dollars. Get a $10 bonus when you signup using this referral link.

Looking for a good crypto phone app that comes with a metal VISA card that rewards you for spending and staking? Check out the crypto.com wallet.

Bybit - Crypto derivatives and spot trading platform. Leverage trading up to 100x. Cold wallet storage. No KYC, just an email address to open an account. Zero maker fees and low taker fees. (Not available in US, China, Singapore, Cuba, Iran..) https://www.bybit.com/en-US/invite?ref=ZP2RNY

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites.

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.