Synthetix - Issue #69

In this newsletter, we are profiling Synthetix [SNX]. In previous newsletters, we have profiled Bitcoin, ZCash, Shiba Inu, THORChain, and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

SNX is currently listed as #116 on CoinMarketCap. Paired against BTC, it has seen 62 weeks of a bear trend. Though against USD, it finally broke out from the downtrend; it is yet to be seen if SNX has seen the bottom for 2022.

Profiling

Synthetix was originally launched as Havven in 2017 as an ICO and was later rebranded. It was founded by Kain Warwick. Synthetix is a decentralized exchange (DEX) available on Synthetix.Exchange and is mainly a platform for creating and trading synthetic assets. Synthetic assets are tokens that represent other cryptos, commodities (like gold and silver), or equity indexes. They were one of the first crypto projects to offer this in a completely trustless and decentralized manner.

The eco-systems token originally had a max supply but is set to transition to inflationary (at a fixed 2.5% APR). It exists on multiple blockchains: Ethereum, Binance Smart Chain, Polygon, Solana, Fantom, HECO, and Avalanche. The tokens are used to earn exchange fees for collateralization and to earn rewards via staking. Every time synthetic assets are minted in the system, SNX is locked up in a smart contract for collateral. All fees are distributed back as staking rewards. The Mintr app also allows you to do liquidity mining, providing assets to their pools to gain weekly rewards. Other exchange features, such as options trading and perpetual futures trading, continue to push usage.

Apart from issuing synthetic assets (“synths” for short), you can also create inverse synths, which equates to “shorting” an asset. Both types of synth assets are highly over-collateralized (usually more than 700%), which can cover substantial price movements and slippage, protecting the traders. Synths can be created using their Mintr app. The underlying value of synths are tracked via oracles to ensure correct pricing. Synths can be traded seamlessly without the worry of liquidity or slippage problems.

As with many DeFi systems, the American SEC has had its eye on Synthetix, and it is unclear whether there will be issues going forward. Synthetic is taking steps to upgrade its governance to become even more decentralized to help with government compliance.

Synthetix is one of the largest DeFi protocols based on total net asset locked value just on the Ethereum blockchain. With all the DeFi players on the board these days, can one of the earlier ones continue to thrive into the future?

Trend Lines

This first chart has SNX paired against BTC on the weekly scale going back to March 2018, when SNX launched on Binance. The first significant increase in value was from May till December 2019, with an increase of over 1700%. The next spike in price started in June and peaked in August 2020 with an over 800% increase. Since then, the value started its bearish trend that seems to be continuing still. If this trend continues, will it hit bottom at about 700 Satoshi as it did in March 2020? That would still be a loss of another 44% of the value.

On the SNX/USDT pairing, we see a slightly different chart. In March 2022, SNX broke out of the bearish trend pattern for a gain of 146%. Though since it has lost more than half of those gains.

If you are interested in buying SNX, you can do so from several exchanges such as Binance, Coinbase, and many others. On Bybit, you can leverage 25x their SNX USDT Perpetual contracts to earn USDT if you are in profit.

The Other Trend Lines

Bitcoin is standing on the edge of support. If this area of support does not hold, BTC could dip to the next support lines of $36,000, $29,000 or even as low as $20,000. Of course, $20,000 would be awesome for those who missed the gravy train prior to 2021. There are many different angles to analyze the charts from, but there is a good case for BTC to break below the current area of support. If it holds and BTC moves up from here, there are also several resistance points between here and $70,000.

The following couple of charts are from Will Clemente’s Twitter feed.

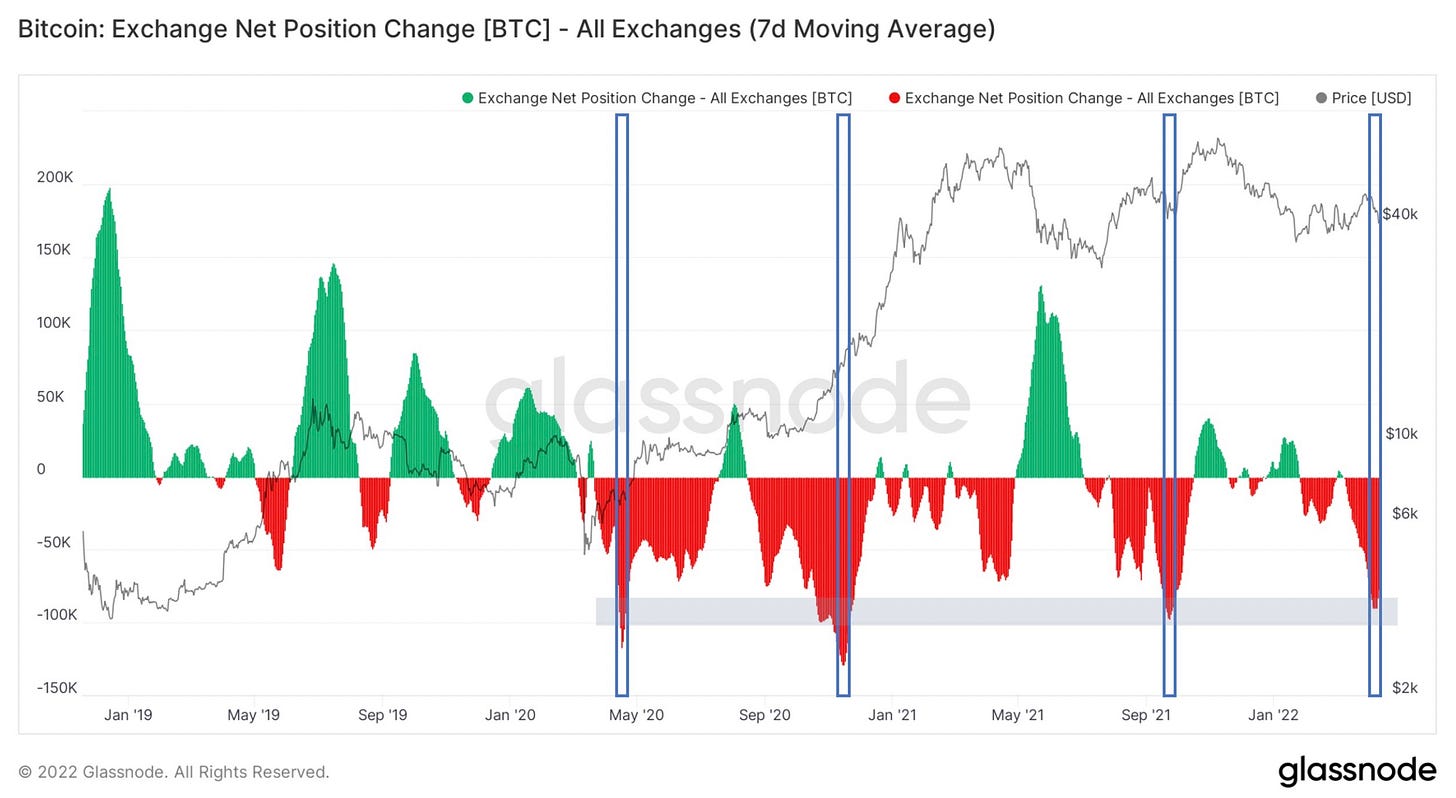

“On only 3 other occasions have we ever seen Bitcoin withdrawn from exchanges at this rate.”

“Only a few other times has Bitcoin reached the zone of heavy opportunity. (green) This is also the longest time Bitcoin has ever spent in the zone.”

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 262% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week, bitcoin has ranged between $38,536 and $41,561 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 69% since the start. The USD fund value is up 296% since the beginning. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -36% against BTC. ETH is up 170% against BTC since the start. ADA has a gain of 267% against BTC and 750% to USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 84% against BTC since the start; LINK is down -40%, WAVES is up 140%, and XMR is up 42%. Overall, against BTC, the fund is up 57% and 11% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

Referral Sponsors

Join Celsius Network using the referral code 1177858d59 when signing up and earn $50 in BTC with your first transfer of $400 or more! https://celsiusnetwork.app.link/1177858d59

Use Netcoins as a Canadian to buy and sell BTC, ETH or LTC using Canadian dollars. Get a $10 bonus when you signup using this referral link.

Looking for a good crypto phone app that comes with a metal VISA card that rewards you for spending and staking? Check out the crypto.com wallet.

Bybit - Crypto derivatives and spot trading platform. Leverage trading up to 100x. Cold wallet storage. No KYC, just an email address to open an account. Zero maker fees and low taker fees. (Not available in US, China, Singapore, Cuba, Iran..) https://www.bybit.com/en-US/invite?ref=ZP2RNY

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites.

Madbyte does have its own token called MADX on the Fantom and Ethereum networks and under symbol Madbyte on the Waves network. The tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.