Tezos, Designed to Evolve - Issue #39

In this newsletter, we are profiling Tezos [XTZ]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

We have covered many different competitors to Ethereum, but none have yet to get close to dethroning it. Tezos had the most buzz around it from 2017-2019 but seemed to have lost some of that to many of its competitors. How will 2021 turn out for Tezos and its native token XTZ?

Profiling

Tezos started life in 2014 when quantitative analyst and programmer Arthur Breitman (aka L. M. Goodman) noticed issues with other cryptocurrencies and wrote the whitepaper for what would become the Tezos blockchain. Tezos had a very successful ICO in 2017 and launched its mainnet in 2018. The project is very similar to Ethereum but is built from the ground up with its own codebase. It is different in that consensus is achieved via Proof-of-Stake, and governance is handled on-chain. Tezos had a number of legal issues starting in 2018, being sued and investigated by the SEC. Luckily, these issues were resolved in 2020. The ecosystem is now maintained and promoted by the Switzerland-based Tezos Foundation.

The token used for gas in the network is called XTZ (or “Tez” for short). The token is inflationary, and hence there is no maximum supply. Supply initially increased approximately 5.5% annually but is currently set at 3.6%. They claim this is required to ensure the blockchain can continue rewarding stakers and maintaining network security indefinitely. Currently, Tezos can handle approximately 18 transactions per second. Throughput was traded for a much higher level of decentralization.

Smart contracts can be created using a functional language called Michelson, which supports Turing-complete code. Consensus is achieved via a customized and controllable version of Delegated Proof-of-Stake (DPoS), which they call Liquid Proof-of-Stake (LPoS). The mechanism is designed to maximize decentralization. Governance is done on-chain, and each XTZ holder can participate, either by holding 8,000 XTZ and running a validator node (called a “baker”) or by delegating to an existing “baker.” Unlike DPoS, the number of validator nodes in LPoS is variable and can be changed by governance. To see the list of top DApps created using Tezos, head over to https://dappradar.com/rankings/protocol/tezos.

Tezos is known to be “self-amending.” The protocol can upgrade itself without having to deal with hard forks. Stakeholders vote on changes, which are then tested. Successfully tested changes are then voted on again for inclusion. The steps in the process are called proposal, exploration, testing, and promotion. This is all done on-chain and facilitates smooth transitions between network iterations.

Most recently, NFTs have become popular on the network, with a number of gaming, racing, and music companies getting involved. For an example marketplace, check out hicetnunc.xyz. Tezos will also soon be added as a supported blockchain on the opensea.io NFT marketplace.

There are many competitors to Ethereum, but Tezos is another strong contender to keep an eye on. With true decentralization and governance, they aim to be the last smart contract blockchain anyone should ever need.

Trend Lines

On this first chart of XTZ/BTC on the one week going back all the way to October 2017, we see the all-time highs were back in May 2018 of 77,890 Satoshi, and now we are down at 7700 Satoshi. This Binance chart is only showing 7 digits instead of the full 8, by-the-way. Holding XTZ has not been very good historically when comparing to BTC. It could be assumed it has to do with the inflationary unlimited supply of the token.

Late 2019 and into 2020, we saw a bull run of 410%, but it still was valued at only half of what it was a couple of years earlier. In August 2020, it started going down and lost 85% and hit an all-time low of 5630 Satoshi on the last week of 2020.

On this daily chart going back to the all-time lows at the end of 2020, we can see how the crypto bull market pushed XTZ/BTC to the all-time highs of 2021 of 14,930 satoshi and a gain of 165%. When you look back at the weekly chart at the same timeframe, it doesn’t seem like anything happened besides sideways movement.

The Tezos token is in a downward trend with consistently creating lower lows and lower highs for a few months now. If this trend continues, we could be hitting the lows from last year as earlier as August. But on the positive side, if Bitcoin continues a bullish upward movement, we should see the overall crypto space, including Tezos, break their bearish trendlines.

If your aim is to gain more fiat such as USD and not just look at BTC gains, then this next chart is great for you. Since early 2019 the trend has been bullish with higher highs and higher lows. Over the past 3 lows, the token has taken 4-5 months to establish a new high against USD. In the last few weeks, the solid part of the candle has been touching the support and now seems to be bouncing upward. Will there be enough momentum for XTZ to touch the top resistance line for gains of about 175% from this higher low?

The Other Trend Lines

The three charts that many have been wondering about are these. On this first Bitcoin chart, there is a higher chance that there could’ve been a breakdown to the low 20,000s from a technical perspective. But three candles (days) ago, BTC broke to the upside, and then it hit a higher high, and that allowed the bulls to take control. Bitcoin is up 35% from 6 days ago.

On this second chart, you see a clear bearish downtrend that broke yesterday. The top of the trendline also had the 50-day moving average as resistance.

The third chart shows the accumulation trendlines that show BTC going sideways. We are getting close to the top, and we should expect some pullback, but I doubt it goes as far down as the 50-day moving average. Above that, there are two more moving averages that could be resistance, the 128-day and 200-day.

Will BTC be over 40,000 USD in August, over 50,000 in October and then double into November and December of 100,000? We will see how the next few resistance lines break or else have BTC bouncing back down once again.

Portfolios

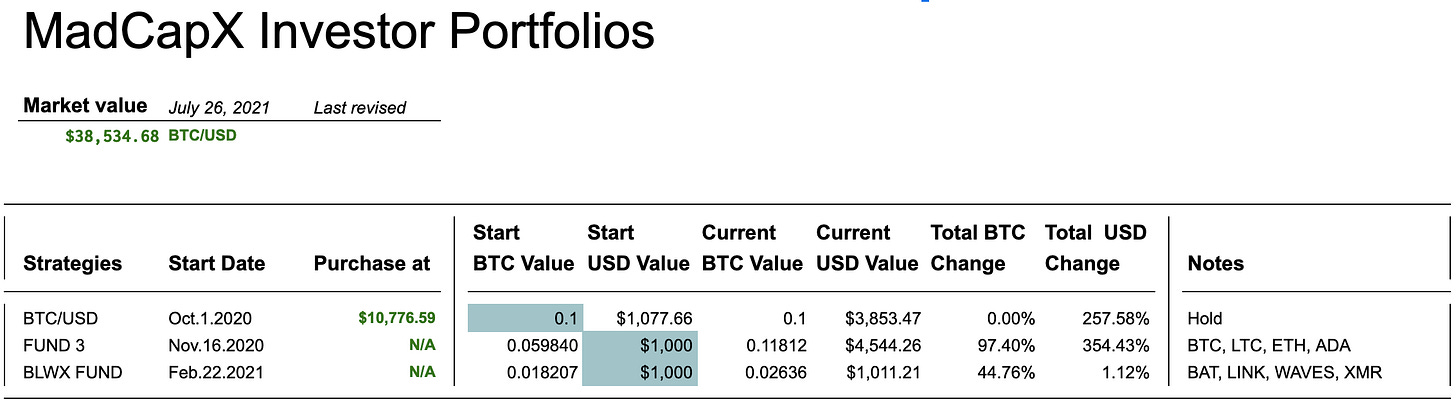

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 257% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $29,278 and $39,800 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 97% since the start. The USD fund value is up 354% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -16% against BTC. ETH is up 121% against BTC since the start. ADA has a gain of 456% against BTC and 1171% to USD.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 49% against BTC since the start; LINK is down -12%, WAVES is up 41%, XMR is down -3%. Overall, against BTC, the fund is up 44% and 1% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This weekly newsletter is a paid subscription and supports the team and the Madbyte projects. The regular cost is $5/month or $50/year. Cancel anytime.

As a paid subscriber, you can request to get access to our Madbyte Discord investor channel. In the channel, we post updates and charts related to the profiled crypto-asset. If you are already a member of our Madbyte Discord server, the investor channel is private for Madcap Tier 12 and above members and this newsletter readers. Discord invite: https://discord.gg/Pfmks83

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.