The Bitcoin Forks BCH, BSV... - Issue #11

In this newsletter, we are profiling the bitcoin forks over the years. In previous newsletters, we have profiled Bitcoin, Ethereum, Litecoin, Polkadot and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Forking bitcoin is basically copying bitcoin’s blockchain into a new chain with a few changes in an attempt to improve on it and hoping that it will become more successful than the one it was forked from. So far, this has proven futile and has made it more resilient than ever.

Portfolio

This portfolio section gives you an idea of what sort of return you can get when investing in cryptocurrencies. Over time, we will introduce other portfolios with different crypto assets.

The BTC Hold is up 191% since October 1st, 2020. Since this is a long term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long term hold position as our best stable alternative.

The BTC/USD fund is up 130% since November 2nd. This past week bitcoin has been ranging between $26,100 and $34,800 USD in value. Once again, seeing a new all-time high this week. From the lows in 2020 to highs this week, it is up 775%.

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH and ADA. The total amount of BTC value from the four coins has a gain of 6.4% since the start. Against USD, it is up 99.48% since the start. We will hold these positions to see how well it does against our BTC-only portfolios. LTC is has a gain of 11.3% against BTC. ETH is the best performing this week with gains of 16.62% against BTC since the start. ADA is up 8.66% since the start against BTC.

Profiling

With the popularity of Bitcoin, the original cryptocurrency, comes many who are so-called purists and want to retain what they see as core values to what Bitcoin should be. During 2017, when transaction fees were starting to skyrocket because of poor scalability, a group of crypto influencers wanted to change Bitcoin’s block size so that each block could contain many more transactions to alleviate fees. The core development team was against this change and wanted instead to focus on Segregated Witness (to store metadata about transactions in a separate block) and the Lightning Network (moving most transactions to a side-chain). The worry about changing the block size was that it would slow down blockchain propagation across the network and thus make Bitcoin more centralized as it would limit the nodes that can handle the new resource requirements. Regardless, the change in blocksize was put into place and In August of 2017, Bitcoin forked to create Bitcoin Cash (BCH). There was a lot of worry at the time as to the effect this would have on the value of both BTC and BCH and which cryptocurrency would become the more accepted one. As it turns out, even with significant backers like entrepreneur Roger Ver and Jihan Wu of Bitmain, the ASIC hardware manufacturer, the original Bitcoin continues to be the favoured coin.

Unfortunately for Bitcoin Cash, the arguing for block size did not stop after the fork. Led by Craig Steven Wright and billionaire Calvin Ayre, the call to increase the block size even more (to 128 megabytes) brought about the fork to Bitcoin SV (which stands for Satoshi’s Vision) in November of 2018. This has proven to be even less popular than the BCH fork.

Lesser-known forks of Bitcoin happened around the same time, with Bitcoin Gold (BTG) in October of 2017 and Bitcoin Diamond (BCD) in November of 2017. Both were created in order to try and stem the growth of ASIC miners by changing the mining algorithm. With the lack of mining support for both of these forks, they have become very vulnerable to 51% hacks, where any entity that controls over half the mining can control the history of transactions, making coin theft possible. Bitcoin Gold has two major attacks in this regard already, causing over $18 million in losses already.

As Bitcoin Cash has very cheap translation fees, it has gained a bit of support from retailers who will gladly accept it as payment. On the other hand, many distrust the influencers behind BCH and see their marketing methods as deceitful. For example, for the longest time, the website bitcoin.com, owned by Roger ver, made it seem like the original Bitcoin was BCH and tricked many new-comers into buying it instead of BTC.

Over time, we keep seeing the Bitcoin forks drop in value. We think any fork can be thought of as a very risky investment. As always, do not take just our word for it, do your own research and come to your own conclusions.

Trends

Over the last 3 years, BCH/BTC is down 95%. Though there have been some good opportunities to profit against Bitcoin but in the long term, it has been a poor investment.

When we compare Bitcoin Cash paired against USD on the weekly chart from May 2019 to Jan 2021, it continues to be on a downward trend, though will BCH break through the upper trend line in the next week or two or will it start heading toward the bottom support line.

Here is an optimistic opinion from a user on TradingView to where BCH might head in 2021 against USD.

Seems like the BCH pair has been accumulated and now moving higher. Grayscale is buying 1800 BCH per day on average during the last month while only 900 BCH are mined. Transactions per day have been going up from 20k to 90k. The noise.cash website getting some traction. I think price will follow.

Roger Ver being the number one promoter of BCH pushes back at Bitcoin on a regular basis. He was an early investor in Bitcoin buying in early 2011 for around $1 per BTC. Since the BCH fork, he has debated Bitcoin maximalists as to which is the better one but the market has clearly chosen BTC as the main one to store wealth into.

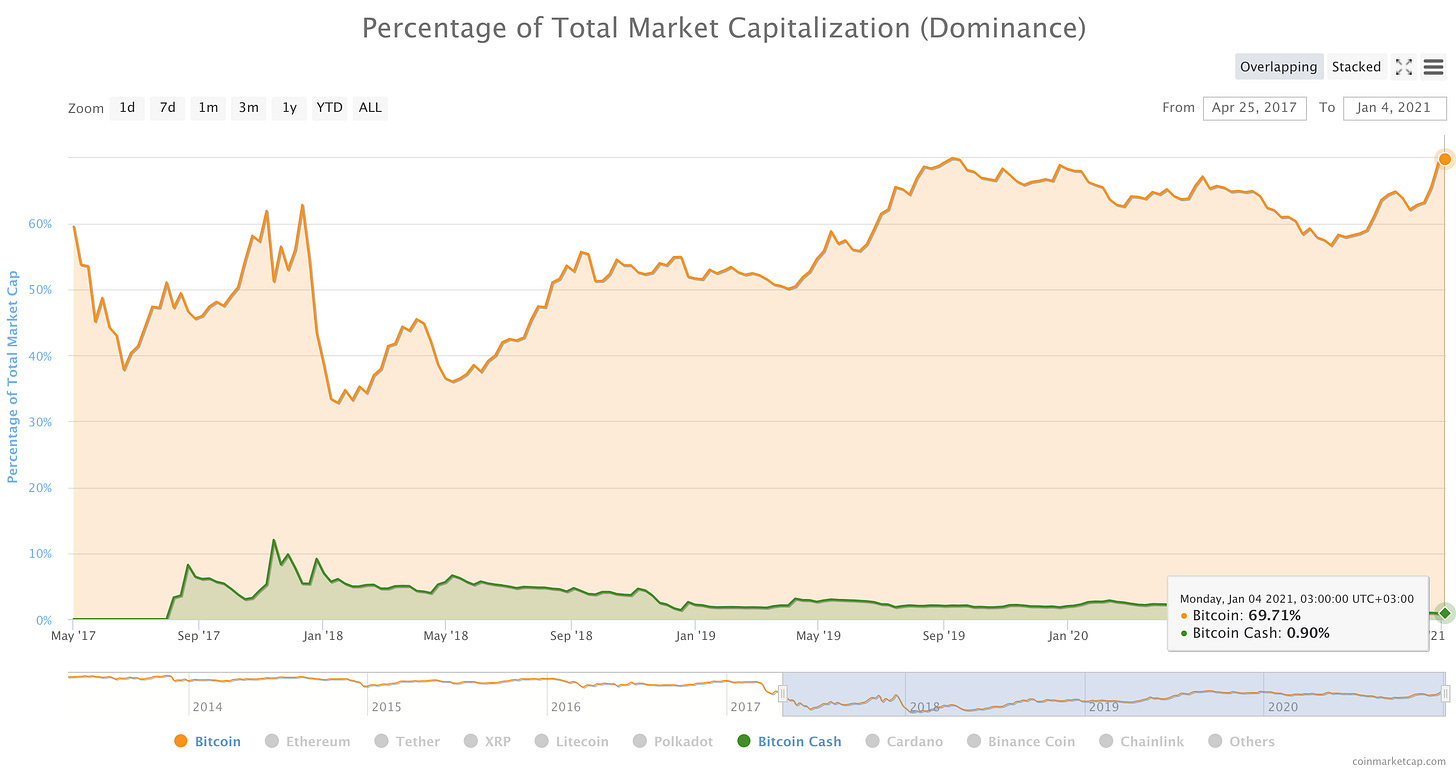

Bitcoin Cash has been losing dominance against Bitcoin at a steady pace since it peaked at 12% a little over 3 years ago and shortly after it was forked. Today Bitcoin Cash is down at 0.90% dominance. It is pretty clear that it is in trouble in challenging BTC now or in the future.

Bitcoin (BTC) has continued to push upwards with regular new all-time highs. Willy Woo says the new floor is now at $24,000 USD. It was just a couple of months ago when some were saying that $10,000 was the floor.

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This weekly newsletter is a paid subscription and supports the team and the Madbyte projects. Subscribe for free and get a limited-time complimentary paid subscription and access to all our archives. The regular cost is $5/month or $50/year. Cancel anytime.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.