UNI and the Decentralized Uniswap Exchange - Issue #16

In this newsletter, we are profiling Uniswap [UNI]. In previous newsletters, we have profiled Bitcoin, Ethereum, Litecoin, Dogecoin, and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Uniswap has billions in its liquidity pools and has reached over a billion in 24-hour trading volumes, making it a serious contender to reach top ten exchange status in 2021. Will this momentum push its UNI token to new highs? Will Bitcoin’s massive moves ever higher force UNI to test lower support?

Portfolio

This portfolio section gives you an idea of what sort of return you can get when investing in cryptocurrencies. Over time, we will introduce other portfolios with different crypto assets.

The BTC Hold is up 299% since October 1st, 2020. Since this is a long term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long term hold position as our best stable alternative.

The BTC/USD fund is up 216% since November 2nd. This past week bitcoin has been ranging between $33,418 and $44,800 USD in value. Giving us a new all-time high for bitcoin. This huge jump today was caused by Tesla announcing a large investment into BTC.

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has a gain of 34% since the start. Against USD, it is up 248% since the start. We will hold these positions to see how well it does against our BTC-only portfolios. LTC has a loss of 12% against BTC. ETH is up 43% against BTC since the start. ADA is up a massive 168% since the start against BTC. There are several altcoins that have had good gains in the past month.

Profiling

Uniswap is the first decentralized exchange (DEX) with automatic market-making built-in. It was built using smart contracts on the Ethereum blockchain back in 2018. As Uniswap is completely open-source, it means anybody can copy and modify their source code to create their own DEX, as we saw happen with Sushiswap. Sushiswap introduced a governance token, SUSHI, and lured away a lot of users from Uniswap last year. With anonymous developers and questionable history and methods, Sushiswap is again taking a back seat to Uniswap as they airdropped their new UNI governance token to all users that had ever performed trades on their platform. The UNI token gives holders the right to vote on changes and new developments to the platform as well as things like future distributions and fee structures.

What makes a DEX like Uniswap unique is its implementation of an automated liquidity pool protocol. Traditional exchanges work by using an order book, where buyers and sellers come together to try and come to agreements on trade by either lowering or raising bids and asks. If there are not enough buyers or sellers active, the market can stagnate, which is seen as a loss in liquidity. Entities who are willing to come in and perform continual and consistent fair market value trades on the asset are known as “market makers”. In Uniswap, you can choose to be a liquidity provider for their pools from which automated trades are made via a deterministic algorithm. When lending your tokens to a pool pair, you get rewarded by gaining extra tokens once you remove them from the pool.

With all this automated activity going on in Uniswap and the ever-increasing popularity of participation, it has caused a huge spike in demand for Ethereum blockchain transactions and thus a huge increase in ETH gas fees. If you look at https://ethgasstation.info/gasguzzlers.php, you will notice that almost 20% of the current gas usage is being caused by the Uniswap smart contract. Solutions are being worked on right now to hopefully fix this issue as it brings a lot of other Etheruem usages to a standstill because of absurd fees.

Trend Lines

The UNI/BTC daily chart going back only 4 months has no historic basis to make any good predictions for the future. The green line is drawn from the top of the solid candle body which could mean some resistance for the current bullishness that is happening with UNI. Over the next few days or weeks, we will see if it will break out or break down. Uniswap exchange continues to have larger trading volumes so the assumption is that it won’t visit the red support line any time soon. Though all assumptions go out the window if Bitcoin makes some huge moves.

This next chart shows possible retracement of UNI before it tests the upper resistance line once again.

From a Tradingview user, hashfurry, on a 6hr chart posted Feb. 2nd, predicted for UNI to test the EMA 50 support but has broken it and is close to breaking through the Ichimoku cloud.

UNI is in a bull run,, but a 6h bearish divergence will dump it to test the EMA 50 support, before its going further. Better for short term trade and and quick increase of stack.

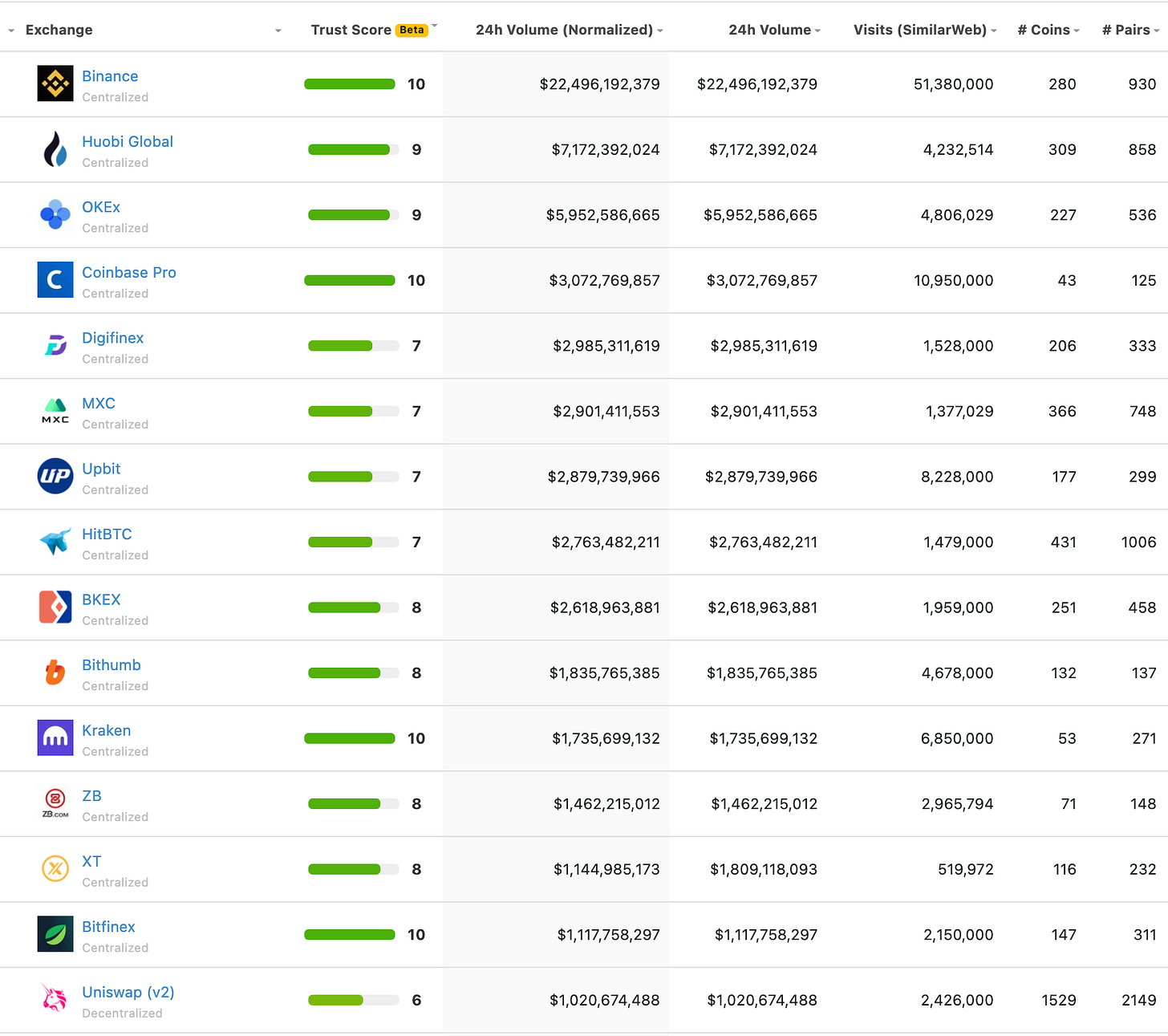

A great measurement of success for an exchange is trading volume. Uniswap has not disappointed in this as volume continues to climb, putting it into the top ranks of all exchanges.

Uniswap (v2) takes the top spot for decentralized exchanges (DEX) by a pretty good margin. The second-place SushiSwap, which is a copycat of Uniswap, has been releasing new features regularly.

Behind closed doors, the Uniswap core developers have been working on v3. For now, it is unknown what Uniswap v3 will look like but there are high expectations for several new features and for their momentum to continue as number one. SushiSwap is managing to catch up to UniSwap by about 2% per week. At this pace, they will become #1 before 2022. Though, it is unlikely that Uniswap will give up their top spot so easily.

Of all the exchanges listed here, UniSwap comes out as 15th in volume. Their trust score is the lowest on this list. They have the most coins and pairs. Binance and Coinbase would be the top exchanges if you take in trust score and then volume.

Tesla used about 15% of its net cash position to purchase $1.5 billion in Bitcoin. In most cases, investors and companies would test the waters by using only 1-2% of net cash. The announcement pushed Bitcoin to increase by $5,000+, already giving Tesla a gain of 25% on the investment. Also, in turn, Tesla's stock was up 2% this morning for a gain of about $15 billion in market cap.

Corporations in general are facing the same issue that financial institutions and individuals have. The US dollar is being printed at an insane rate causing uncertainty in future purchasing power. Corporations are forced to seek an asset that will protect them and they are turning to Bitcoin.

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This weekly newsletter is a paid subscription and supports the team and the Madbyte projects. Subscribe for free and get a limited-time complimentary paid subscription and access to all our archives. The regular cost is $5/month or $50/year. Cancel anytime.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.