What is Maker? - Issue #32

In this newsletter, we are profiling Maker [MKR]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

Your banker may not have heard of Maker, but Maker is coming for a piece of your banker’s pie. Will regulators stop DeFi projects before they roll over traditional banking as Netflix did to Blockbuster? Your house flip loan could be cheaper and easier from a crypto project like Maker in the near future.

Profiling

MakerDAO is a smart contract lending platform where users borrow funds by locking in collateral in exchange for the DAI stable coin. It was created in 2015 by entrepreneur Rune Christensen and fully launched in 2017. It is one of the earliest projects to appear on the decentralized finance (DeFi) scene. The system functions similar to a bank in that it provides loans and charges interest. Maker (MKR) is the governance token (residing on the Ethereum blockchain) of the MakerDAO and Maker Protocol, as well as being used for fees and as a resource for recapitalization.

MakerDAO launched with 1,000,000 MKR tokens at its inception, with the total supply fluctuating depending on the current state of the system. The supply of MKR will increase if the system is running a deficit and needs to dilute MKR as a recapitalization source. The supply will decrease via burning if there is a surplus in the system. The issuance and removal of MKR from the system are governed by a complex system of interdependent mechanisms and smart contracts that are designed to ensure that DAI is always fully collateralized by other cryptocurrency assets and its peg to USD is maintained. There are no hard-coded upper or lower limits on the total supply of MKR. The system automatically attempts to continually stabilize the price of DAI at 1 USD.

Users can borrow DAI by providing collateral assets approved by “Maker Governance” into so-called “vaults.” This is called entering a “Collateralized Debt Position,” or CDP. In the case of a drop in value of a vault’s assets, the system automatically initiates the liquidation of the vault’s contents, the proceeds of which it uses to cover that vault’s obligations. If the amount of DAI generated during the liquidation is not enough, the protocol mints new MKR tokens to sell and cover the remaining sum.

The governance is community-driven and can be participated in via staking MKR tokens. Stakers determine network specs and governance initiatives, including the stability fee, collateralization rates, and assets allowed to be used as collateral. They also have a say in choosing oracles used by the system and upgrades to the code.

An important feature of the system is the “Emergency Shutdown,” which allows the system to shut down and make underlying collateral available for redemption by DAI holders and vault owners. This locks the system and prevents vault creation and the ability to generate DAI, as well as locally freezing all reference prices. There are a few ways in which the shutdown can be triggered. First, if the total supply of MKR drops below a certain minimum level. Second, via executive vote. Finally, in cases of attacks on the system, significant economic issues, and major upgrades.

The major competition to Maker protocol is other stable coins and lending platforms. Maker has the unique advantage of being fully decentralized, as most other stable coin systems are centralized and have some company that provides resources to sustain their pegging to the USD. If you like the idea of smart contracts rather than companies handling the stabilization of value, MKR / DAI is the combo for you!

Trend Lines

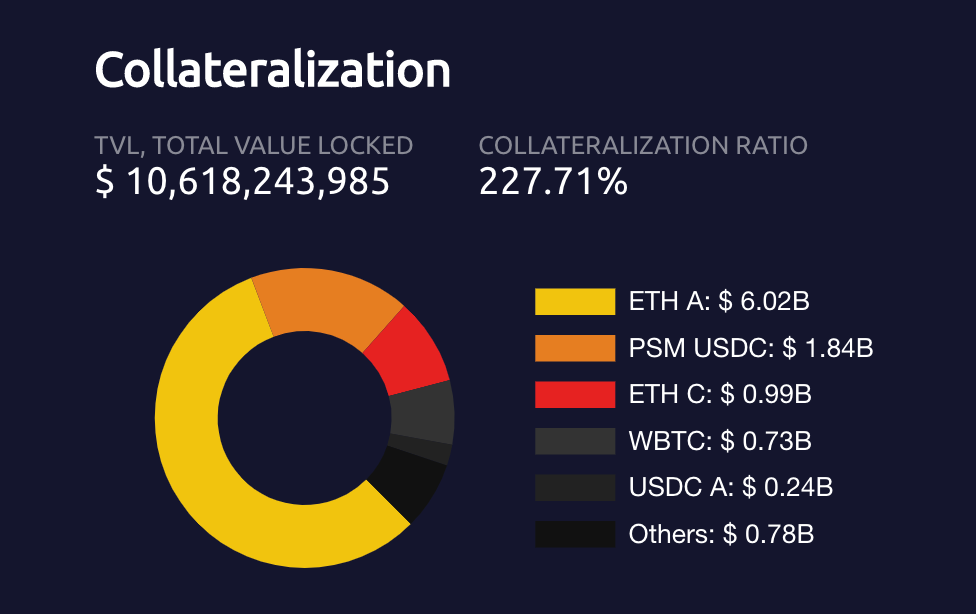

Maker has been tracking very closely to the crypto market value as in the chart above. MKR is in blue, and ETH is in orange. The close tie Maker has with ETH, and the broader crypto market is its DAI stable coin. The multi collateral Dai has ETH, BTC and many others; the value locked is worth over 10 billion.

Will this close relationship in value to ETH continue over the next few years as Maker tokens become more scarce?

In this chart, we see the MKR/USD pairing in the green against the yellow line showing the amount of MKR getting burned. The red line shows profits generated by Maker fees which are being used to buy back MKR tokens and then burn them. Similar to what Binance is doing with BNB.

The annual profit is at $143 million from the different fees that are charged on the Maker platform. The estimate is to burn another 39,000 out of a total current supply of approx 900,000 in circulation.

Like many other top-tier digital assets that have gone up since January 2021, Maker is no different, and it has risen over 1000% against USD. At the beginning of May, the whole crypto market started plummeting, and so did Maker; it fell back nicely into a channel that it had created a few months earlier. Will we see the channel contain MKR or see another breakout sooner than later? It is definitely an asset to watch closely.

The Other Stuff

Here’s our tweet storm…

There is no lack of predictions in the market. Some are waiting for Bitcoin to go back down to 20k so they can pile all in, as others are watching to see if we start heading back up so that 100k is reached.

There is no doubt we will continue to see the value increase over the years for the best crypto projects that continue developing. Later this year, Bitcoin gets taproot, Cardano has another smart contract implementation, Ethereum’s v2 could be released this year, and the large variety of Defi projects within the space continue to turn heads in the traditional financial circles.

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 240% since October 1st, 2020 but down slightly from last week. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week Bitcoin has been ranging between $36,480 and $40,840 USD in value.

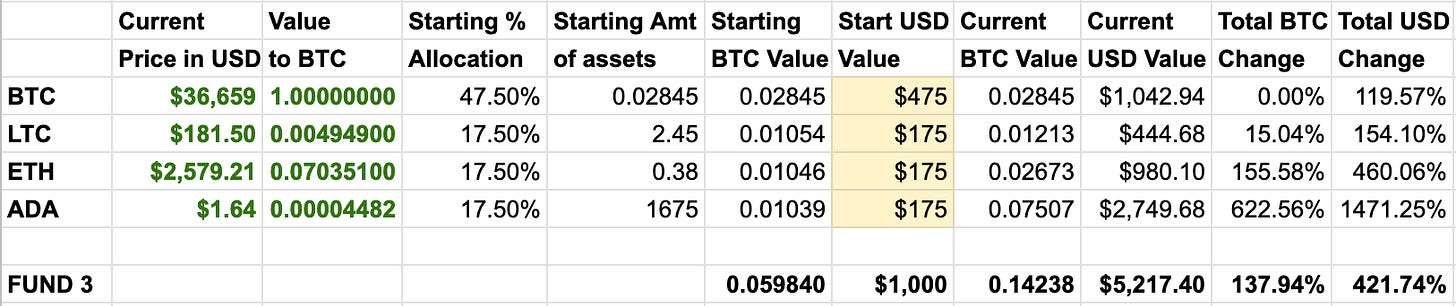

FUND 3 started on November 16, 2020, with $1000 USD in value and invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has gained 69% since the start. The USD fund value is up 421% since the start. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is up only 15% against BTC. ETH is up 155% against BTC since the start. ADA has a gain of 622% against BTC and 1471% to USD. ADA continues to be the best investment of all the coins in this portfolio section.

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 98% against BTC since the start; LINK is up 43%, WAVES is up 72%, XMR is up 64%. Overall, against BTC, the fund is up 69% and 13% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites. This weekly newsletter is a paid subscription and supports the team and the Madbyte projects. The regular cost is $5/month or $50/year. Get it free for 90 days; cancel anytime.

As a paid subscriber, you can request to get access to our Madbyte Discord investor channel. In the channel, we post updates and charts related to the profiled crypto-asset. If you are already a member of our Madbyte Discord server, the investor channel is private for Madcap Tier 12 and above members and this newsletter readers. Discord invite: https://discord.gg/Pfmks83

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.