Zilliqa - Issue #49

In this newsletter, we are profiling Zilliqa [ZIL]. In previous newsletters, we have profiled Bitcoin, Cardano, Stablecoins, Uniswap and many others. Access all our newsletters in our archives at madcapx.substack.com.

The Short of It

ZIL is currently number 88 on CoinMarketCap at a $1.1 billion market cap. ADA at #4 sits at $70B, and SOL at #6 is at $49B. And these are chasing the smart contract leader ETH at $396B. Is ZIL even in the race at #88? Or is this an opportunity that the majority of crypto-asset traders haven’t really noticed?

Profiling

Zilliqa development started back in 2017, with its mainnet going live in 2019. It was created by Prateek Saxena, an assistant professor at Singapore's School of Computing. ZIL was initially released as an ERC20 token. It is another smart contract blockchain that seeks to solve issues of speed and scalability via sharding and is, in fact, the first public blockchain that launched with sharding. They aim to become the choice for enterprise use, gaming, financial services, and the payment industry.

ZIL is used for network transaction fees and smart contract executing, as well as for staking, yield farming, and block rewards. Consensus is achieved via Byzantine Fault Tolerance (pBFT) and can currently do 2,800 transactions per second. The maximum supply of ZIL is set to 21 billion. 60% of all supply was distributed at their token generation event, with the remaining 40% to be created via their mining process. Zilliqa is designed so that all of its tokens will be mined within ten years.

As Zilliqa is sharding-focused, a tiny bit of Proof-of-Work is done by a node to create a digital identity to then be able to assign it to a shard. The pBFT consensus protocol is used after that. A new language, called Scilla, was created for the purpose of making smart contracts. It is safety-focused and intended to identify and eliminate security vulnerabilities automatically. Each smart contract can also be verified for safety via mathematical proofs. The ecosystem has a strong 1000+ developer community, and they have a good number of popular dapps. Decentralized ZIL domain names are available to be had from unstoppabledomains.com.

ZILHive is the ecosystem’s growth initiative which currently supports over 70 projects via grants, incubations, and mentorship. Some big grant recipients include Unstoppable Domains, Transak, and TEEX. They are moving more into NFTs and recently released their soccer NFT marketplace at football.zilstars.com. Also recently released is their Ethereum bridge at zilswap.io/bridge.

Zilliqa has a governance token called gZIL (which was previously accrued when staking ZIL). Via the Pillar Protocol, gZIL holders will be able to control aspects of that DeFi application. This has “Pillar Stable Coin,” which is a USD-backed stablecoin.

So, do you like what you see with Zilliqa? It is another in the long line of hopeful Ethereum-killers. This one has not really exploded in popularity yet, and only time will tell how successful it will be.

Trend Lines

ZIL on this weekly chart in Bitcoin satoshi (sats) topped out in May 2018 at 2508 sats, and the low was March 2020 of 50 sats. ZIL hovered under 100 sats for 39 weeks before starting a bullish trend against BTC.

April 2020, ZIL started this bull trend. The first move up was about 450% then went down for a few months and then went up over 220% and third rise was 168%. ZIL is currently in the valley with a couple of support lines that could hold it up. The current bullish trend line and the previous lows from early 2021 and again in July. There could be buying opportunities in between 175-200 sats. The all-time lows are about 75% down from here, so also be careful if the current supports don’t hold.

On the USD chart, ZIL in March 2020 hit as low as $0.002 and had a moon shoot of 11,971% up to $0.26 USD. Currently, ZIL is hovering at about $0.10. Will BTC takeoff before the end of the year and altcoins start into a bull run shortly after? ZIL could see 150%+ gains if it goes back to all-time highs once again from here.

This video is 8 minutes related to ZIL price and explaining the bullish case.

This video by Charles Hoskinson from Cardano is not about price but a quick 3 minute take on him being slightly negative on the ZIL community.

The Other Trend Lines

BTC on the daily chart shows us the recent all-time high made in April 2021 of $64,850 and then we went down to $28,800 USD in June 2021. At the beginning of October we broke out of the downward trend that started September 7th. There are plenty of predictions for BTC to break the highs once again as early as this month or latest by end of the year.

BTC seems to have found good support above $46,800. As you can see on this chart below, it touched it and quickly moved back up. BTC could stay in a sideways pattern between $47,000-$50,000 for a bit. The longer it stays here, the higher it could move once it breaks.

Portfolios

This portfolio section gives you an idea of what sort of return you can get when investing in crypto assets.

BTC/USD FUND is up 356% since October 1st, 2020. Since this is a long-term holding, it is best kept in cold wallet storage or a safe custody solution. We continue to see a long-term hold position as our best stable alternative. This past week bitcoin has been ranging between $40,753 and $49,500 USD in value.

FUND 3 started on November 16, 2020, with $1000 USD in value and was invested into BTC, LTC, ETH, and ADA. The total amount of BTC value from the four coins has had a gain of 131% since the start. The USD fund value is up 580% since the beginning. We will hold these positions to see how well it does against our BTC-only portfolio. LTC is down -20% against BTC. ETH is up 151% against BTC since the start. ADA has a gain of 625% against BTC and 2015% to USD.

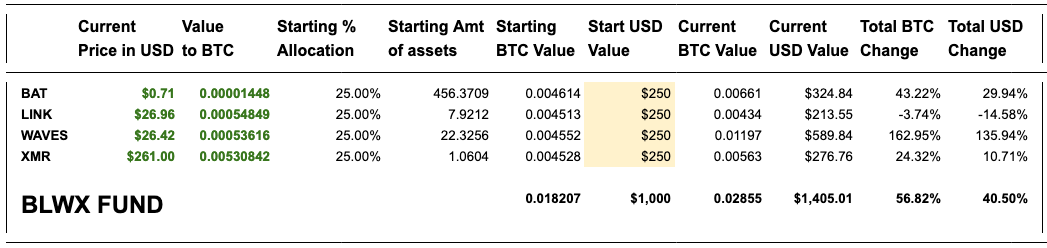

BLWX Fund started on February 22, 2021. They all are assets we have profiled in the last few months, and we are interested in how they will perform in 2021 against BTC. BAT has a gain of 43% against BTC since the start; LINK is down -3%, WAVES is up 162%, XMR is up 24%. Overall, against BTC, the fund is up 56% and 40% against USD.

Overall, Bitcoin should be your first choice as an investment in crypto, though many digital assets can give you amazing gains if you manage your risk. As a long-term investor, we see it as our largest portfolio investment. If you are a day trader, there are many great assets to put on your watch list. Look through our previous newsletters to find some.

Referral Sponsor

Join Celsius Network using the referral code 1177858d59 when signing up and earn $50 in BTC with your first transfer of $400 or more! https://celsiusnetwork.app.link/1177858d59

Use Netcoins as a Canadian to buy and sell BTC, ETH or LTC using Canadian dollars. Get a $10 bonus when you signup using this referral link.

Looking for a good crypto phone app that comes with a metal VISA card that rewards you for spending and staking? Check out the crypto.com wallet.

Bybit - Crypto derivatives and spot trading platform. Leverage trading up to 100x. Cold wallet storage. No KYC, just an email address to open an account. Zero maker fees and low taker fees. (Not available in US, China, Singapore, Cuba, Iran..) https://www.bybit.com/en-US/invite?ref=ZP2RNY

About

MadCapX research newsletter is written by the Madbyte Team. You can learn more about Madbyte and MadCapX on our websites.

Madbyte does have its own token called MADX on the Ethereum network and Madbyte on the Waves network. The two tokens are interchangeable on Madcapx.com.

Disclaimer: Nothing in this newsletter is intended to serve as financial advice. Therefore, do your own research and due diligence before applying any of the techniques highlighted in this post. Any risks or trades based on this newsletter are committed at your own risk.